Top takeaways from the MarketLive 2011 Consumer Shopping Survey

October 27, 2011 Leave a Comment

We hope you caught yesterday’s presentation of the results of the 2011 MarketLive Consumer Shopping Survey, which showcased dozens of actionable holiday tactics and examples along with the survey results. If you didn’t catch the Webinar, visit marketlive.com to access a replay and download a whitepaper detailing key tactics from the study.

Meantime, though, we wanted to share three key concepts to consider when fine-tuning holiday offers:

1. Shoppers do recognize value beyond low prices …

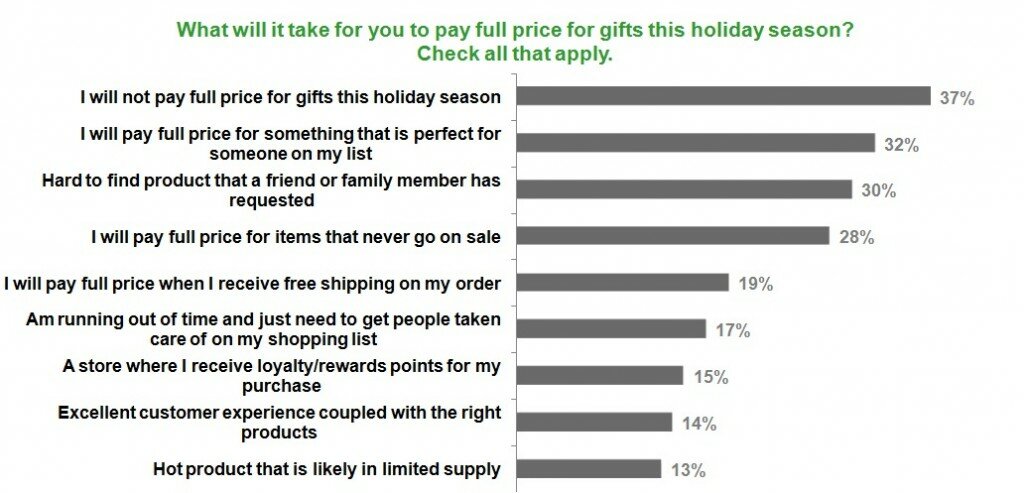

In the opening slides of the Webinar, we learned that merchants hope to hold the line on discounting this year by setting price breaks early and keeping them relatively uniform — in the 20 to 30 percent off range — throughout the season. Happily, the results of the consumer survey suggest this goal may be attainable: shoppers aren’t categorically against paying full price for items, and they recognize that the value of a brand goes beyond the discounts it offers.

According to survey data, nearly one in three shoppers will pay full price for an item that is “perfect for someone on my list”, while 30% will pay full price for a unique or hard-to-find item someone on their list has requested.

One of the best ways to connect shoppers with those “perfect” products — and maximize the potential for selling items without margin-destroying discounts — is via a gift guide or gifting center. But MarketLive’s research revealed that many merchants are slow off the blocks this holiday season, with just one in four Web sites promoting the holidays as of Oct. 21 — compared with 2010, when a majority of merchants had already kicked off their holiday campaigns. If you haven’t already, launch those gift guides pronto. Be sure to cater to an array of shopping styles, as Title Nine does here with a section devoted to gifts by price point, a link to the latest seasonal items and gift cards – which 42% of consumers seek when shopping for gifts.

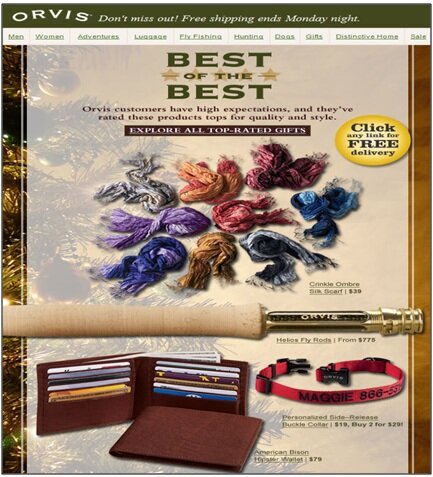

Additionally, capitalize on the willingness to pay for just-right gifts by showcasing unique and limited-stock items, and by playing up customer favorites that are proven pleasers with categories such as “top sellers” and “top rated”. An Orvis email campaign from 2010 highlighted “top-rated gifts” and promised they would deliver on “quality and style.”

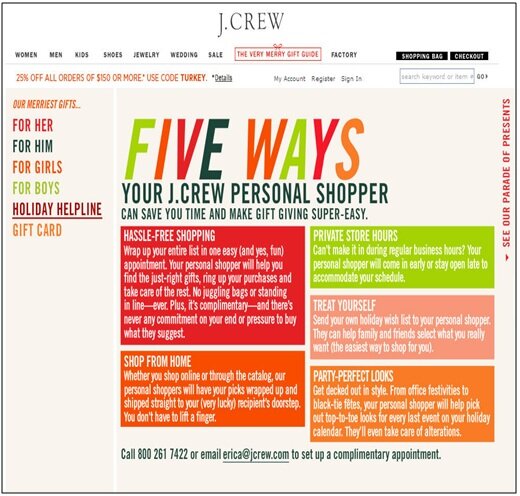

Another strong component of value: customer service. Fourteen percent of shoppers said they’d pay full price for an item that came coupled with an “excellent customer experience”, while 73% of shoppers named free returns as a top promotion — a preference that stresses the importance of holiday shopping that is not only economical, but hassle-free from start to finish. To emphasize the value of great customer service, display product guarantees and return policies prominently, along with customer service contact information in the form of an 800 number and, if you offer it, click-to-call and click-to-chat options. And consider going the extra mile by promoting customer service as its own discrete offering, as J. Crew does with its Personal Shopper service, which promotes convenience and “hassle-free shopping”.

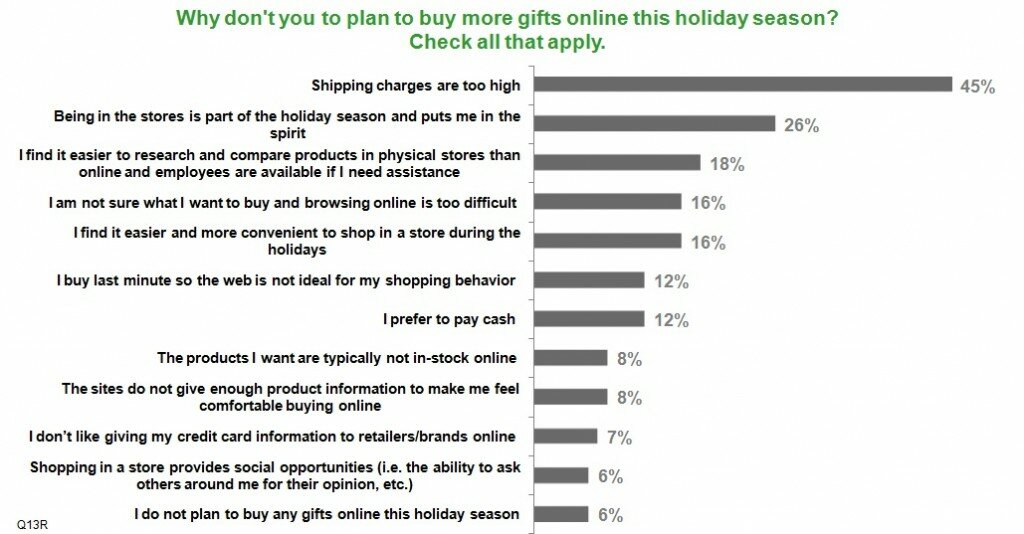

2. … but they still want that free shipping discount

Although shoppers may be willing to pay full price for products, they still perceive shipping costs to be prohibitive. When asked why they don’t buy more online, fully 45% of shoppers named high shipping costs as the top impediment — dwarfing other reasons by a large margin.

As a result, free shipping continues to be the top promotion influencing purchases, with 83% saying free shipping with no threshold is key, and 60% saying free shipping with a threshold spurs action.

But this reluctance to pay for delivery doesn’t mean you have to offer free shipping at all costs. Instead, craft free shipping offers with thresholds that appeal to your core audience — and consider offering free shipping on all orders for extremely limited periods, as the Solutions Catalog does with its “Deal du Jour” offer, which promises free shipping for four mid-day hours only.

During the Q & A session, a Webinar attendee asked what alternatives to provide if she categorically could not offer free shipping as a promotion. In this challenging situation, panelists recommended several alternatives:

- Consider making an exception for loyal shoppers and top spenders. Giving them a free shipping offer no one else receives strengthens their connection to the brand. Alternatively, offer them a gift card good for future purchases when they buy holiday gifts.

- Consider flat-rate shipping. Making the shipping expense predictable and easy to understand is a widely-used alternative to free shipping, that can be tied to a threshold or offered unconditionally.

- Consider offering customers free shipping upgrades with a threshold as the holidays near. This method not only gives shoppers a price break, but eases concerns about whether gifts will arrive in time as well.

3. Prime your mobile presence for heavy research.

While mobile commerce has been on the upswing, survey data suggests that most consumers will actually complete their transactions in other channels. Just 11% of survey respondents said they planned to purchase gifts on their cellphones during the upcoming holiday season.

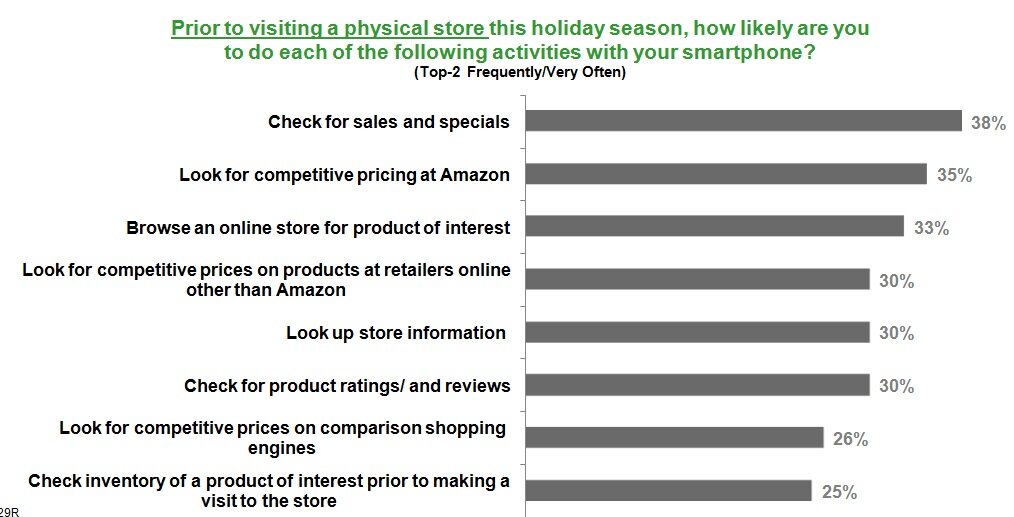

But researching gifts is another matter. Overall 61% of shoppers said they planned to research gifts online or on their phones before buying them on- or offline. Furthermore, the survey found that among smartphone users, nearly 40% will use their mobile devices to look up sale offers and specials before heading to the store, with price comparisons and searches for information about bricks-and-mortar locations also popular.

Predicted in-store activity was nearly as heavy, with more than one in five saying they would check Amazon for price comparison while in the aisles, and 22% of shoppers saying they would use their smartphones to download product coupons while on-site.

To assist shoppers with research and point them efficiently to in-store deals, design holiday gift guide specifically for mobile viewing, and spruce up your store locator — it should display not just store hours and maps for locations, but also specific in-store sales and promotions, as well as special holiday events. And don’t forget to use SMS messaging to deliver deals that entice shoppers into stores; according to survey data, fully 34% of mobile phone users have shared their number with at least one retailer to receive deals. Fashion retailer Armani’s “Text Love Get Love” campaign offered an instant incentive for shoppers to share their information, with a $20 discount coupon for their next purchase.

If you attended the holiday survey Webinar, what were the key takeaways for you? What tactics are you planning to emphasize value?

Connect with us: