Trend to watch: Alternative payments

January 19, 2012 Leave a Comment

On a recent tour of checkout processes, it seemed like more merchants than ever were offering multiple forms of payment — that is, not only could shoppers pay by entering credit card information, but they could also opt to use alternative payment systems such as PayPal or Google Checkout.

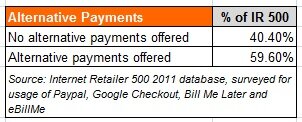

Our hunch was confirmed when we crunched numbers from the Internet Retailer 500 database of leading merchants. It turns out that nearly 60% of merchants on the list offer some form of alternative payment, as measured by usage of leading services Paypal, Google Checkout, Bill Me Later and eBillMe.

Our hunch was confirmed when we crunched numbers from the Internet Retailer 500 database of leading merchants. It turns out that nearly 60% of merchants on the list offer some form of alternative payment, as measured by usage of leading services Paypal, Google Checkout, Bill Me Later and eBillMe.

Data from industry researcher Forrester further substantiates this finding, with 41% of merchants reporting as of June 2011 that alternative payments were a priority, and 32% reporting the feature was effective — beating out other initiatives such as single-page checkout.

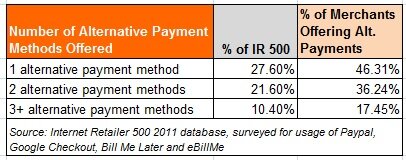

Not only do the majority of IR 500 merchants offer alternative payments, but most of those who do so — 53.9% — offer more than one such service, giving shoppers maximum flexibility when completing transactions.

Not only do the majority of IR 500 merchants offer alternative payments, but most of those who do so — 53.9% — offer more than one such service, giving shoppers maximum flexibility when completing transactions.

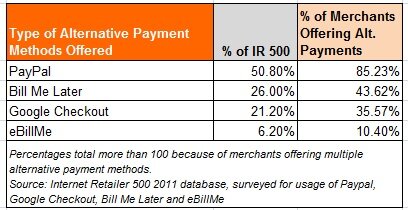

According to the IR 500 data, Paypal continues to reign supreme, with more than 85% of alternative-payment merchants using the service — more than half of the IR 500 list overall. BillMeLater and Google Checkout run a distant second and third, with 43.62% and 35.57% of alternative-payment merchants using them, respectively — still more than one in five of all merchants in the IR 500. And relative newcomer eBillMe, which links directly to shoppers’ bank accounts, is used by 17.45% of alternative-payment merchants, or one in 10 IR 500 merchants overall.

Merchants have incorporated alternative payments to such an extent because customer demand is strong. In 2009, when Forrester last surveyed alternative payment usage, 70% of online U.S. consumers reported active use of an alternative payment service. According to Forrester, top reasons for using alternative payments included:

- Security – The ability to make purchases by entering just a username and password, rather than credit card information, helps build shoppers’ confidence that the transaction is secure.

- Convenience – Rather than re-entering credit card data at multiple sites, shoppers reported saving time by using alternative payment services instead.

- Benefits – Alternative payment services offer many of the same features as credit cards, such as fraud and damage protection.

We’ll be on the lookout for how alternative payment methods fared during the 2011 holiday season, and in future posts we’ll share best practices for deployment. Meantime, merchants that haven’t yet implemented alternative payments would do well to add them to the 2012 priority list.

Do you use alternative payments? If not, are you considering deploying them for 2012? Why or why not?

Connect with us: