Top 2012 priority: Mobile

February 16, 2012 1 Comment

Daily deals? Behavioral targeting? New SEO techniques? Social media? With 2012 showing strong promise for sales growth — while still requiring merchants to operate on lean marketing and development budgets — focusing on core priorities is as tricky as it is essential.

But even amidst a constantly-shifting landscape, one priority has emerged that only promises to become more important over time: mobile commerce. The disruptive power and sales opportunities this medium offer are unparalleled — and should cause merchants to rethink not only specific tactics and techniques, but the way their businesses operate altogether across channels and devices.

It’s no surprise that most U.S. consumers are now equipped with mobile phones. Industry researcher Forrester estimates that 2012 will see the U.S. population of mobile phone subscribers reach more than 258 million, with 110 million of those being smartphone users whose devices can browse the Web and employ apps to enrich the user experience.

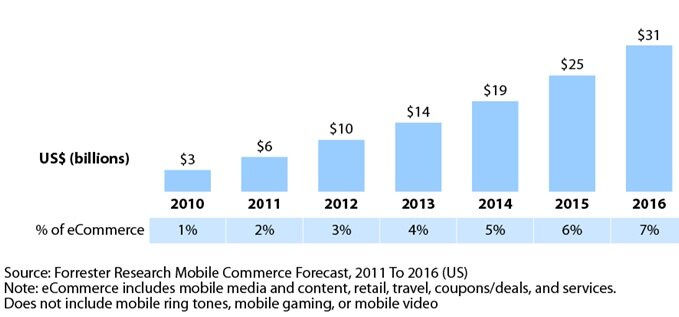

Furthermore, those mobile users will make $10 billion of purchases on their phones this year, according to Forrester — 3% of all eCommerce spending — and that revenue figure is set to more than triple by 2016.

Those who doubt the forecast should consider the recent 2011 holiday season, when mobile shopping played a significant role. Just a couple of statistics:

- Mobile shopping helped nearly four in ten U.S. smartphone users locate the best deals, according to a poll by SapientNitro and GfK Roper. Fully 56% of tablet owners reported using their device to locate deals, the poll found.

- Traffic and sales from mobile devices on key shopping days increased exponentially over 2010, according to IBM CoreMetrics data. On Cyber Monday, for example, 10.8% of shoppers used a mobile device to visit a merchant’s Web site, compared to 3.9% of shoppers in 2010 — a more than 175% increase. Mobile revenues jumped 186%, from 2.3% of all online sales to 6.6%, according to CoreMetrics.

But it’s not just the dollars and cents of mobile commerce that merchants should take into account; it’s the way mobile devices have exploded traditional ideas of shopping — whether in-store or online. Mobile has:

- Disrupted the traditional “multi-channel” path to purchase. Shoppers who might once have researched at home online before visiting a bricks-and-mortar store to complete their purchases can now pause at any time and anywhere to compare prices, look up product information and potentially navigate elsewhere. In 2011, 56% of smartphone users reported firing up their devices to research products while in-store, according to WSL/StrategicRetail — a 60% increase from 2010.

- Liberated “eCommerce” from the computer workstation. Rather than being tethered to shopping online at the home computer (or surreptitiously at work), shoppers can not only peruse products on the go, but tablet devices offer a rich shopping experience in front of the TV and elsewhere around the house.

- Opened up possibilities for geographic targeting like never before. Robust store locators are only the tip of the iceberg; the ability to tap geo-location data has the potential to help merchants serve shoppers with more relevant products and offers than ever.

Given all the juicy potential mobile represents, merchants so far have been slow to seize the initiative. In June of 2011, Forrester found that just 29% of merchants have enacted a mobile strategy — while more than half, 52%, reported being in the pre-implementation stage, from developing a strategy to not having one at all.

It’s true that mobile commerce faces some significant hurdles. While shoppers freely use their phones to research products, they by and large remain dubious about purchasing in the mobile environment — expressing many of the same trust-inhibiting factors that stood in the way of eCommerce growth a decade ago.

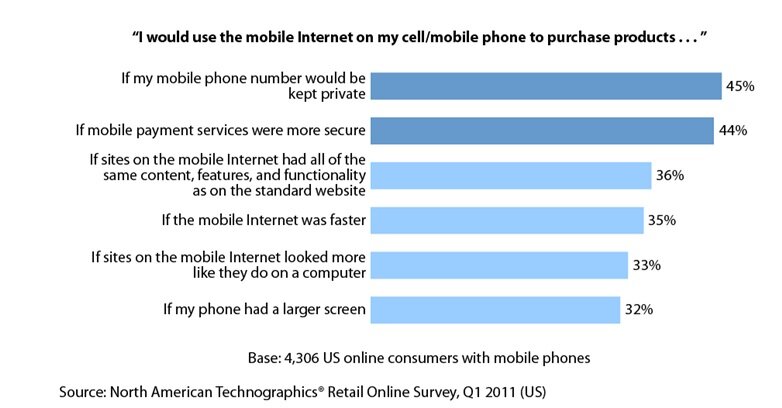

Forrester found that the two leading inhibitions to mobile shopping are privacy — a concern for 45% of U.S. online consumers with mobile phones — and security of mobile payments, which struck a chord with 44% of respondents.

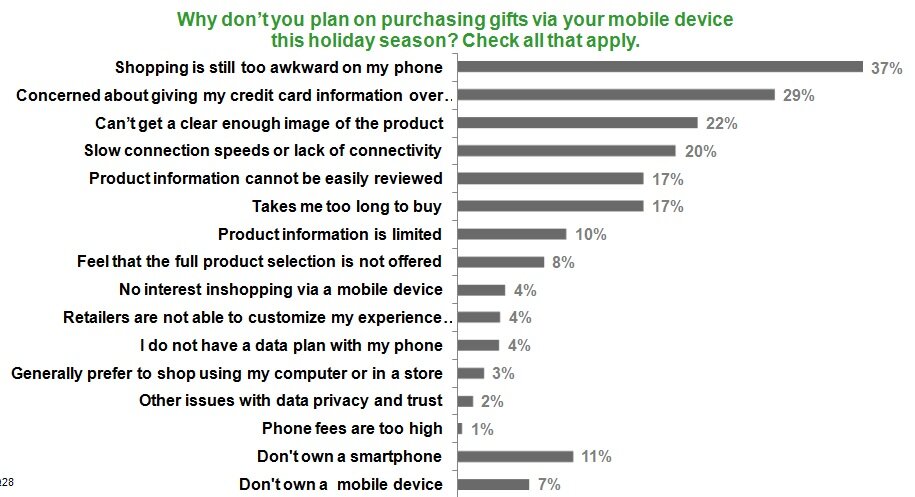

In addition, more than one in three consumers reported that mobile sites don’t offer enough content, features and functionality — a sentiment echoed in the 2011 MarketLIve Consumer Survey, which found that shoppers planned to avoid purchasing on mobile phones because “shopping is still too awkward on my phone”, and in particular offered too little image and product information to fuel purchase decisions.

But these concerns are no reason for merchants to throw in the towel. Rather, they must rise to the challenge so they can better reap mobile’s potential rewards.

Put another way, consumers’ expectations for privacy, security and a feature-rich environment no longer wax and wane depending on which device they use; they expect to encounter a seamless experience across all a merchant’s customer touchpoints, starting with mobile. Failure to meet these high expectations can result in bad publicity — and, worse, lost sales and loyalty.

Because we believe mobile is a cornerstone of connected commerce, we’ll soon publish a whitepaper that examines 2012 mobile strategies in-depth. Meantime, our next post will outline methods for prioritizing mobile development for your business.

Is mobile commerce a priority for your business? Why or why not? What mobile strategies have worked for you?

Pingback: Kate Spade strengthens mobile strategy with shoppable ad … | Near Field Communication (NFC) / Smart mCommerce