The mobile analytics to track now for holiday success

July 30, 2013 Leave a Comment

Mobile is poised to have a huge impact on the upcoming holiday season. By some estimates, in 2012 fully a third of traffic to merchant web sites was from mobile devices, while on the biggest shopping day of the year — Cyber Monday — fully 13% of online revenue was from mobile devices, a 96% increase compared with 2011. With more tablet and smartphone users shopping on their devices with each passing month, it’s no wonder many merchants have prioritized mobile as a key offering to encourage year-end sales.

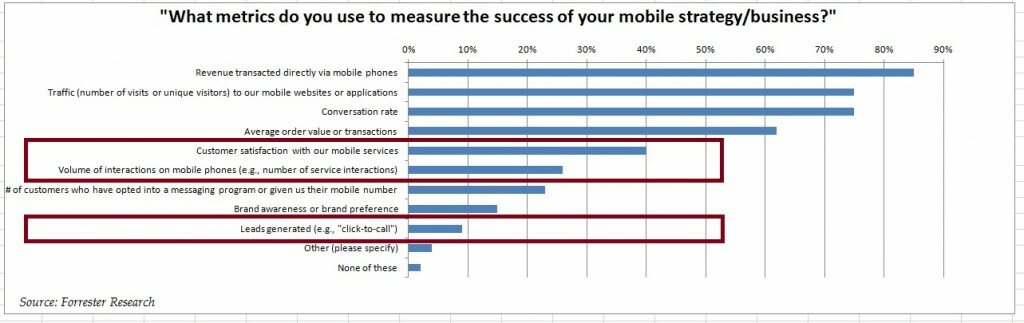

Given the central importance of mobile, new research about the use of mobile analytics comes as a shock. More than 40% of retailers have failed to identify mobile KPIs, according to technology researcher Forrester — and the same percentage lack any kind of mobile analytics solution.

Merchants should remedy this situation immediately if they want to attain holiday success — not only so they can establish a baseline against which to compare mobile activity during the season itself, but so they can analyze current activity and tweak offerings prior to the peak sales period. Among the metrics to track:

Cart and checkout fallout by device. Among the retailers who do use mobile analytics, revenue and conversion are among the top three metrics they track, along with traffic. But given that smartphone conversion is at an abysmal 1%, and tablet conversion still lags behind the purchase rate of browsers on desktop and laptop computers, it’s crucial for merchants to conduct a “deep dive” and understand where shoppers on various devices encounter stumbling blocks on the mobile path to purchase.

Customer service metrics. Another disappointing tidbit from the Forrester data: less than 40% of retailers track customer satisfaction with mobile offerings.

But with stellar customer service an important brand differentiator, merchants should attempt to gauge satisfaction with offerings on every device — not just the main eCommerce site. Tactics for monitoring mobile satisfaction include:

-

Use of “click to call” specifically for the customer service phone number. Connect mobile data with referral data from the call center to get a complete picture of how often mobile shoppers resort to speaking with representatives in person, what triggers the calls, and how successful those interactions are.

-

Exit pages within customer service content. If particular pages are causing shoppers to abandon the mobile site, merchants should consider revamping and/or repositioning access to them for an improved experience.

-

The outcome of mobile site search queries related to customer service. Popular terms should yield plenty of results, including shortcuts to commonly-sought information such as store locations and shipping policies.

Cross-touchpoint synchronicity. Merchants should find ways to go beyond simply monitoring traffic to the store locator to gain a deeper understanding of how shoppers move from mobile devices to desktop or laptop browsing to physical stores and back again. Metrics to consider:

-

Signups for in-store classes or events. Merchants should track any potential conversions related to activites in physical outlets, thereby gaining a deeper understanding of the content shoppers seek.

-

Scans of QR codes in-store. Giving shoppers the ability to access further product and service content than is available on store displays is a distinct advantage of mobile, and merchants should make such activity trackable by using QR codes that connect to custom landing pages.

-

Scans of mobile coupons. By tracking the number of mobile coupon redemptions and connecting that data to order size and product information, merchants can compare performance with traditional paper coupons and refine offers accordingly.

-

Click-to-call specifically to store locations. As with customer service calls, merchants should identify the triggers for calls to physical store locations to gauge whether additional location-specific content is needed on the mobile site.

-

Cross-touchpoint activity by loyalty club users. While connecting the in-store and online behavior of casual shoppers is difficult, merchants who offer a loyalty or free shipping club have a better chance of tying together disparate data points.

What mobile metrics are you tracking, and how have they impacted your mobile strategy?

Connect with us: