Merchants have long known that a picture is worth a thousand words when it comes to online selling. According to Internet Retailer’s database of the top 500 merchants, 72.8% of the largest U.S. eCommerce sites offer multiple product views, 85.8% offer an enlarged view of products, and 53.8% use zoom functionality to let shoppers hone in on specific product features.

While such tools greatly enhance the effectiveness of eCommerce site product pages, they’re no longer enough. A growing number of signs indicate that the Internet is becoming an increasingly visual, rather than textual, medium — which means it’s time for merchants to expand their view, as it were, of how to use images to promote their brands and merchandise. Consider these trends:

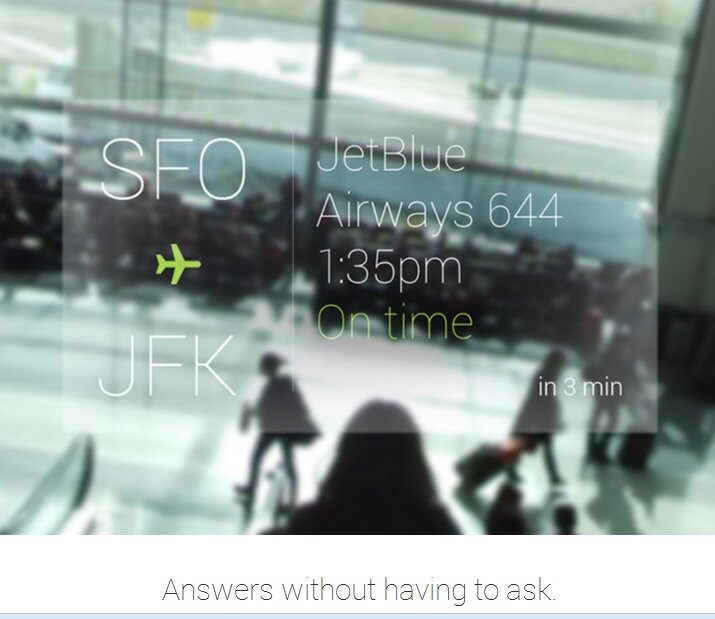

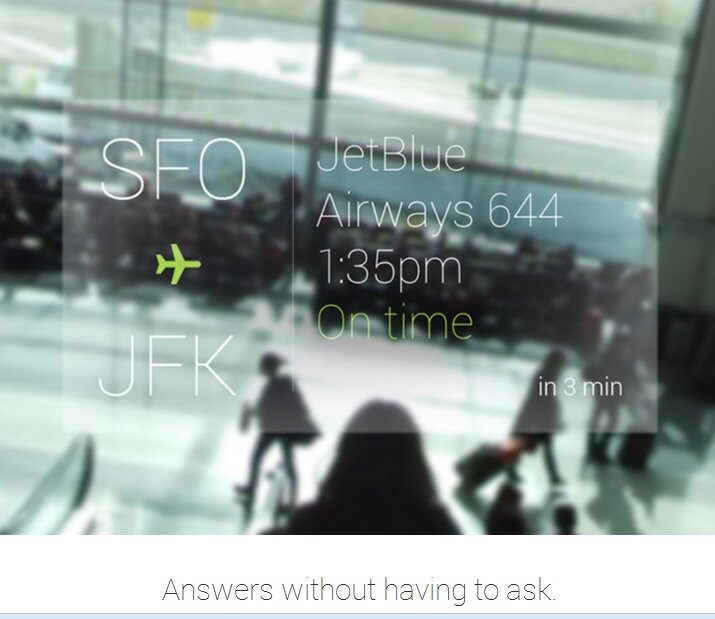

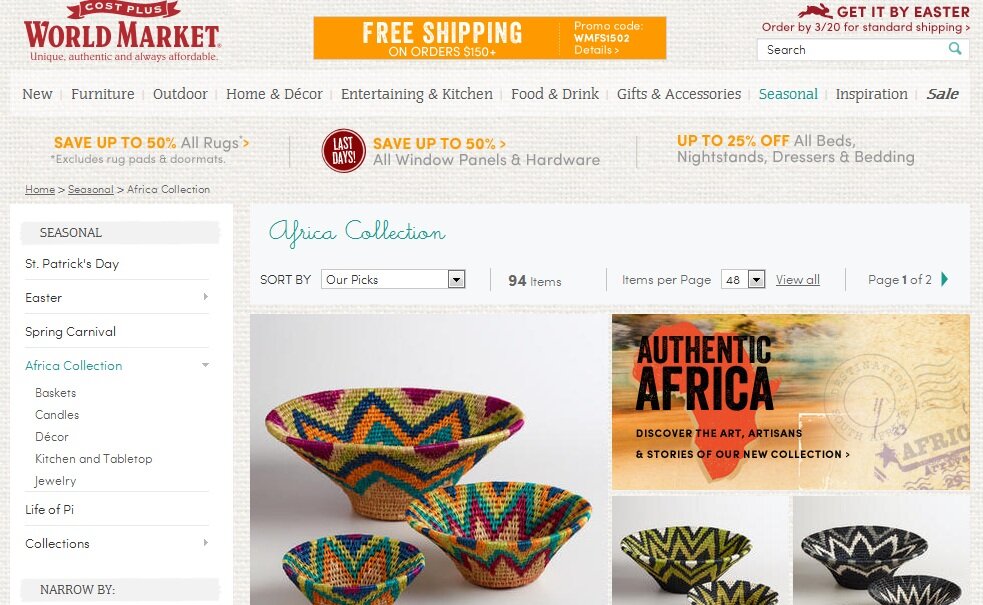

New technological capabilities process information visually. Building off the growing ubiquity of cameras built into mobile devices, a slew of new technologies enable consumers to take pictures and then retrieve related information from the Internet. Google’s mobile app, Goggles, rather than keywords, while the company’s and promises to give users instant access to information on whatever they’re seeing, without even having to snap a picture.

QR codes that connect consumers to content via scannable codes are also part of the trend; their usage has grown exponentially; fully one in five U.S. smartphone users scanned a QR code as of a year ago, according to data from comScore.

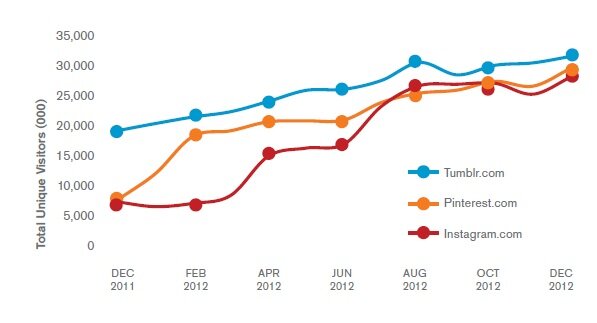

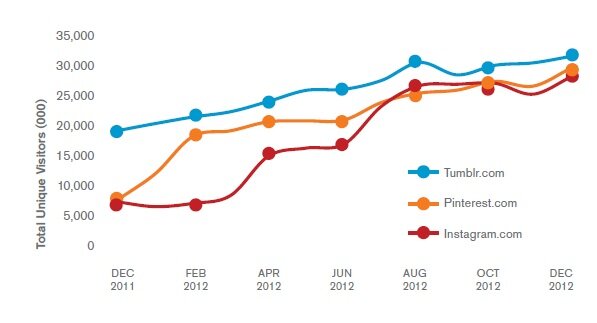

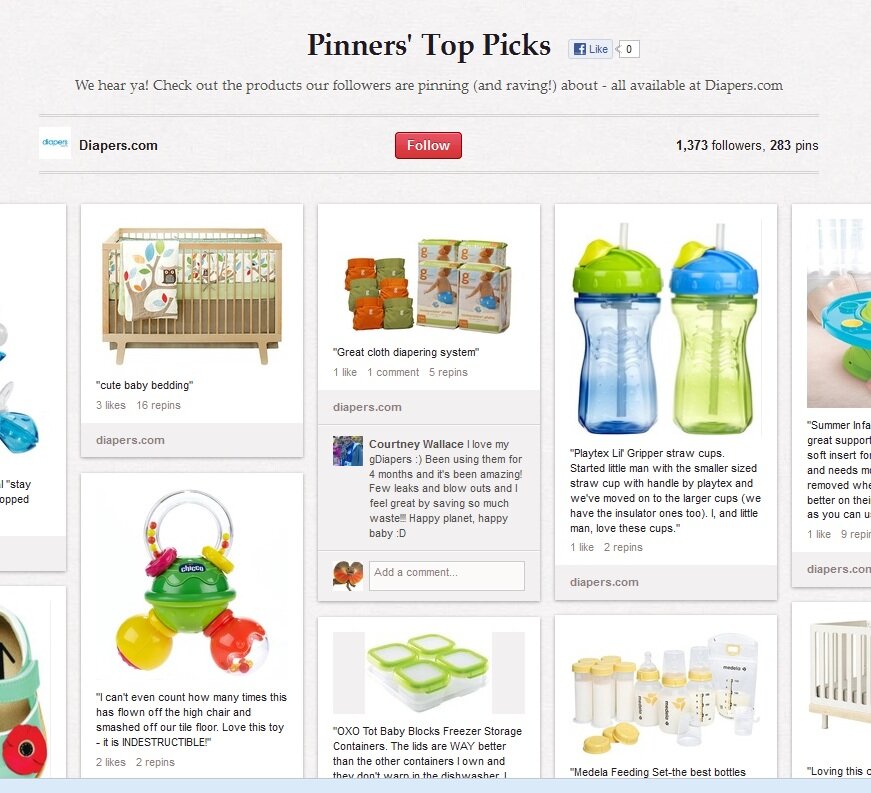

The fastest-growing social phenomena are image-centric. We’ve commented before on the meteoric rise of Pinterest, the social networking site where users share images and links through visually-oriented “pinboards”. But it’s not the only picture-oriented social site that has taken off. According to data from measurement firm comScore, the visual blogging tool Tumblr and the snapshot-sharing site Instagram have also amassed tens of millions of users since launching, and Instagram shares Pinterest’s blistering 284% year-over-year growth rate. The phenomenon isn’t limited to still images, either, with video-sharing tools such as SocialCam, Viddy and Vine rapidly finding audiences.

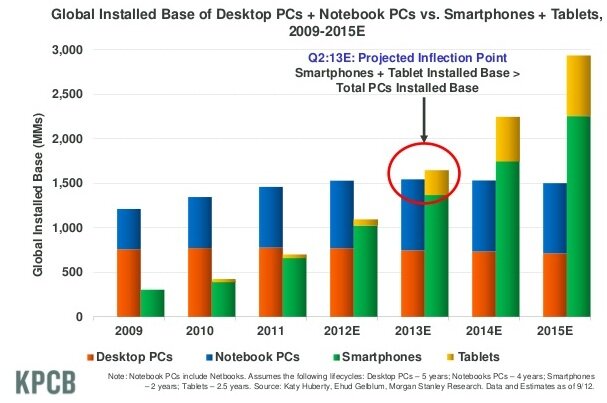

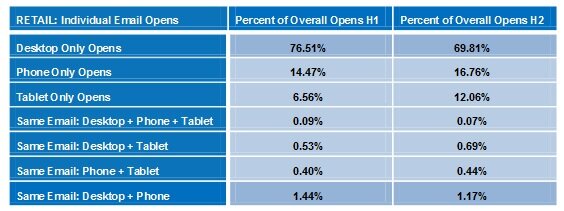

Boundaries between screens are disappearing. Fully 58% of U.S. adults go online while watching TV, according to industry researcher Forrester, with tablet computers providing an essential bridge between computer and television: more than 90% of tablet owners use them at home in the living room or bedroom, according to eMarketer — suggesting they’re used for companion browsing while the TV is on — and at the same time they’re large enough to serve as portable televisions themselves, with more than 1 in 3 tablet owners using them to watch movies and nearly 1 in 4 using them to watch TV shows, eMarketer found. This rich mix of visual content and online connectivity is an increasingly ripe opportunity for brands to engage shoppers during leisure hours when they’re receptive to browsing and buying.

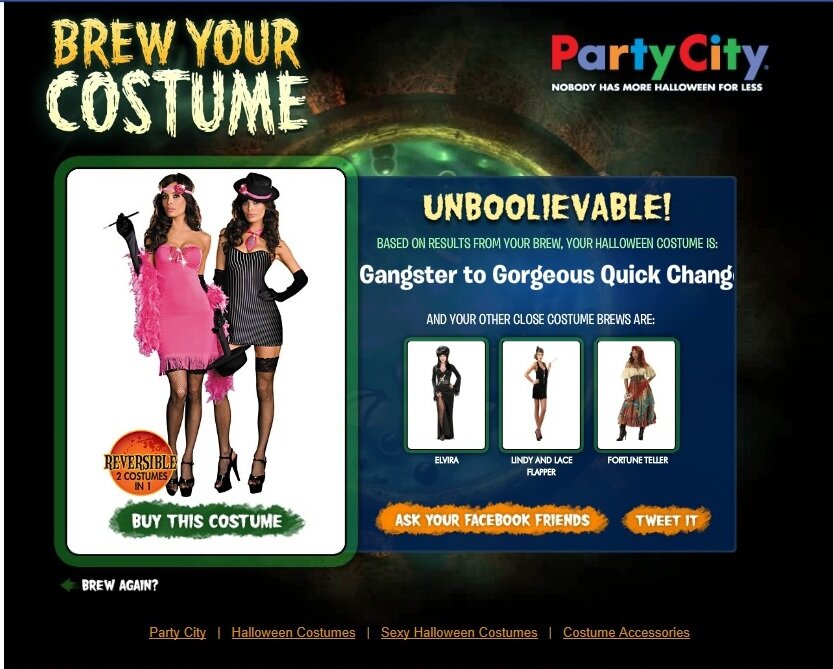

For merchants, these trends suggest an emerging imperative to engage shoppers visually at every stage of the customer lifecycle. Now is the time to re-imagine the shopping experience to take into account what Trendwatching.com calls the “Point-Know-Buy” culture, and to experiment with new strategies for combining products, offers and images. A few starting points:

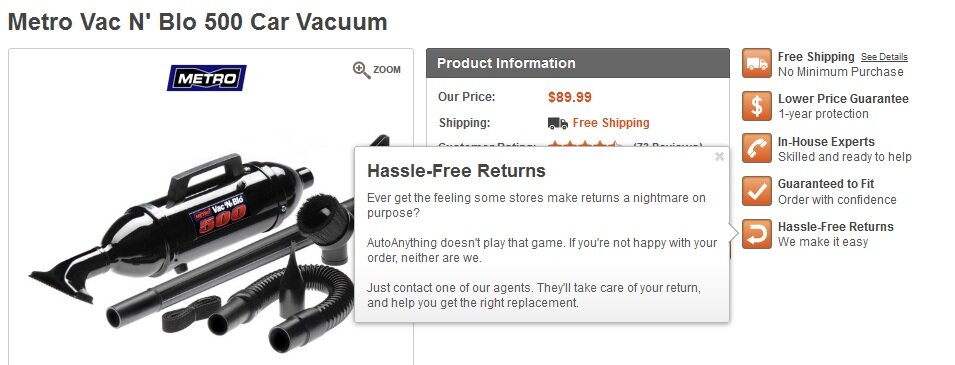

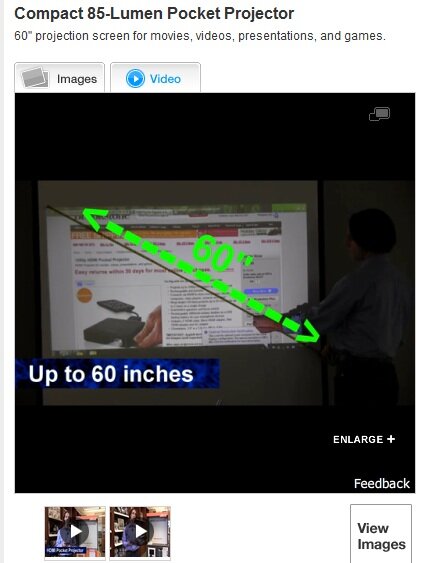

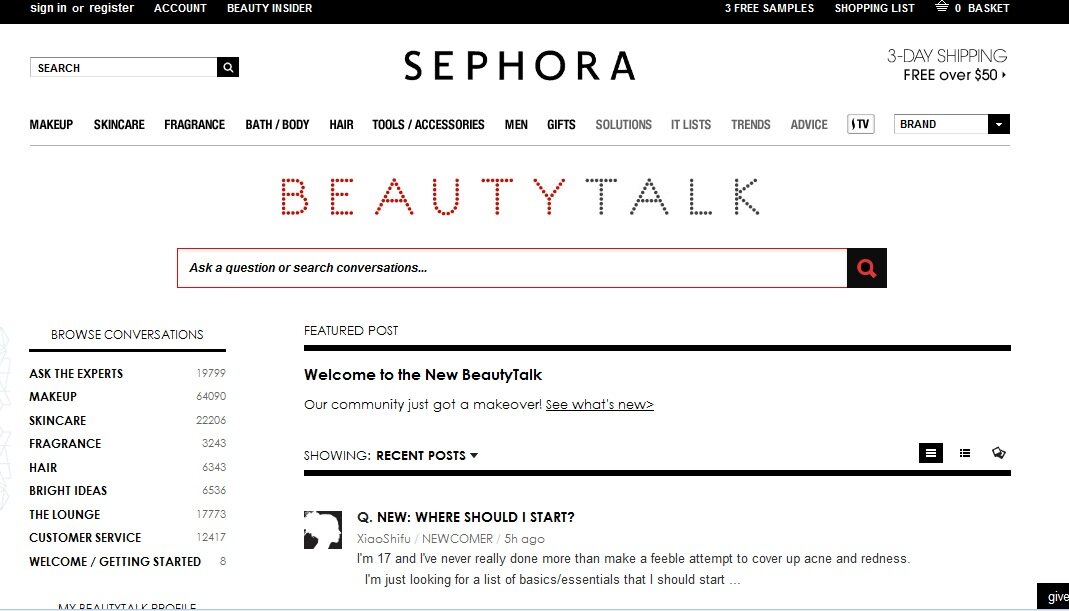

Use video for more than product demos. When devising video strategy, merchants should create compelling content that supports the brand and the lifestyle, not just individual products. How-to content, footage from the brand’s archives, and behind-the-scenes event videos can all enhance the shopping experience visually. Note that these opportunities aren’t limited to brands with “sexy” product offerings such as high fashion apparel or designer home furnishings; more mundane products can benefit from in-depth video treatment, as demonstrated by Yankee Candle Co., which offers an array of video content about getting the most from their products, including a video on “basic candle care”. Such offerings establish the brand as the leading information resource on candles, boosting the credibility of the brand while simultaneously helping shoppers make purchase decisions.

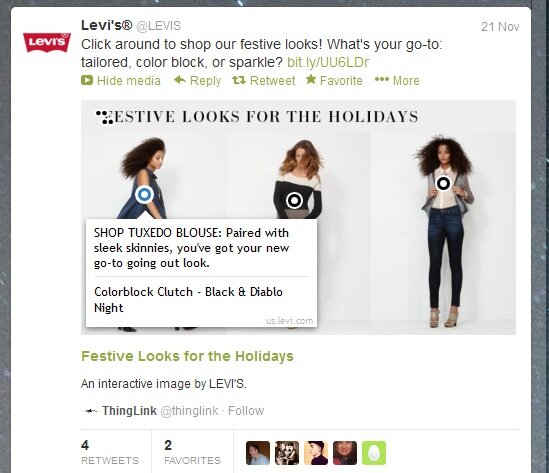

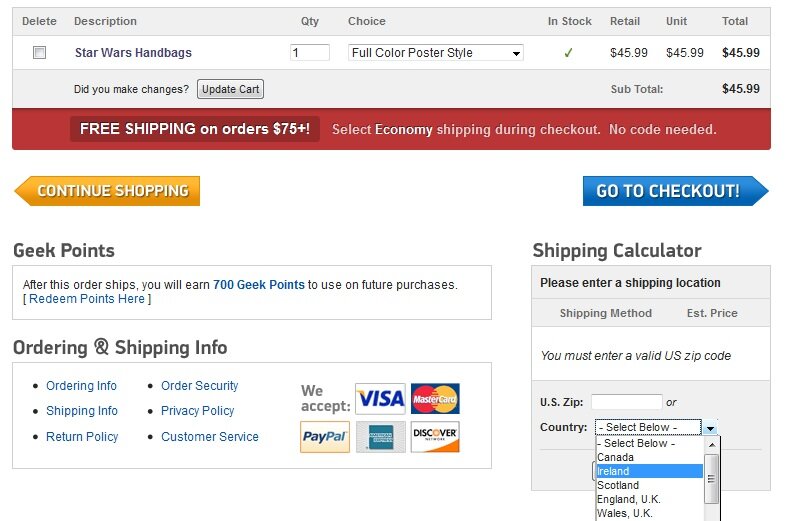

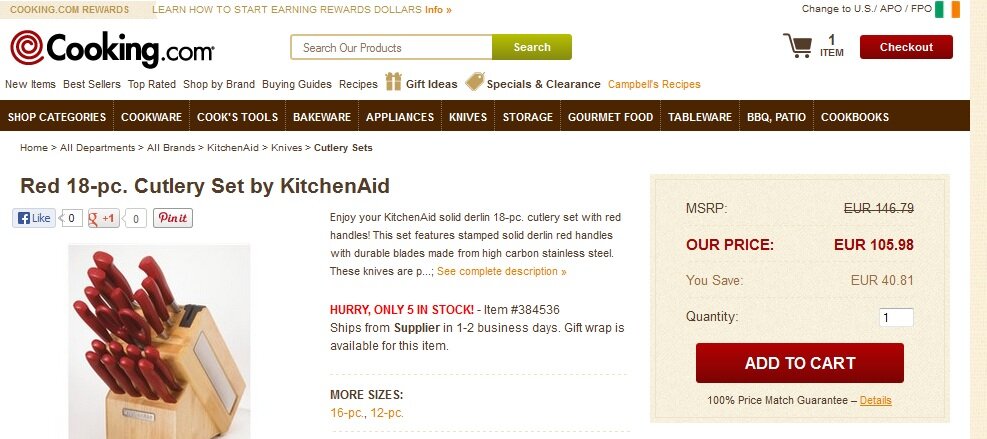

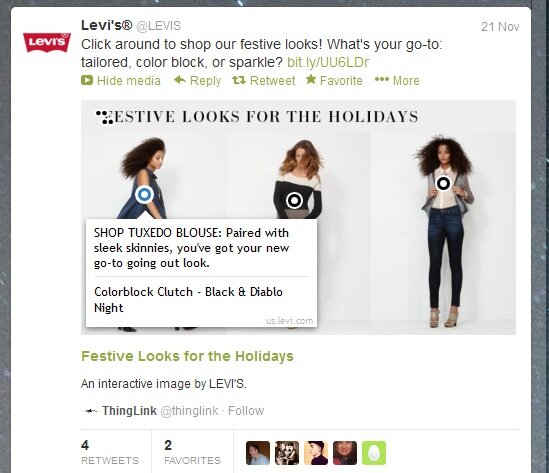

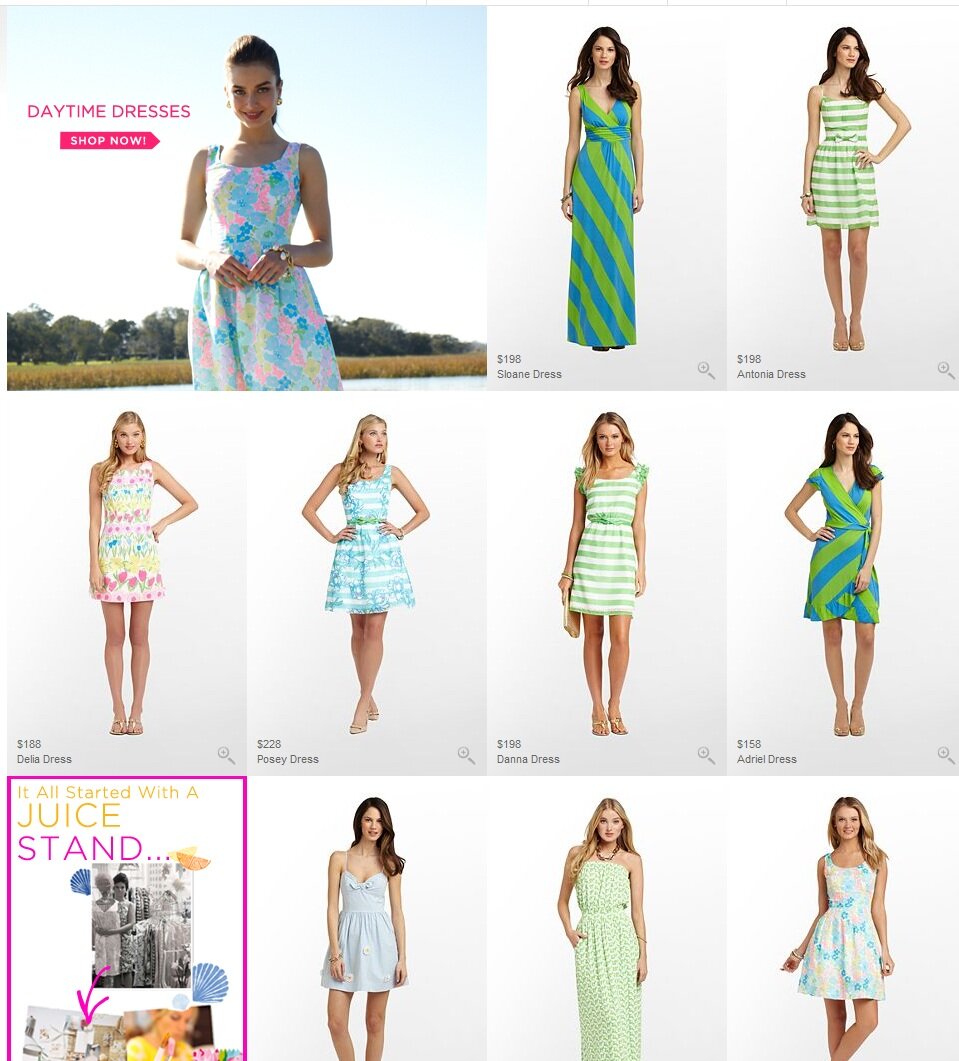

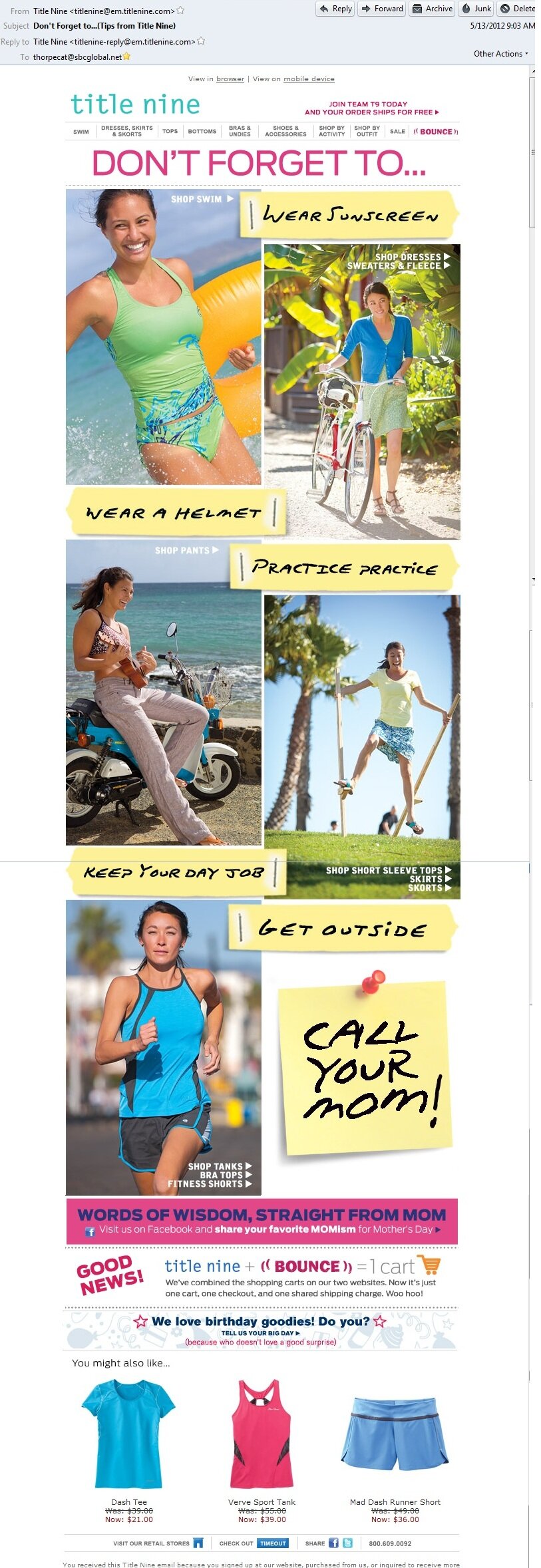

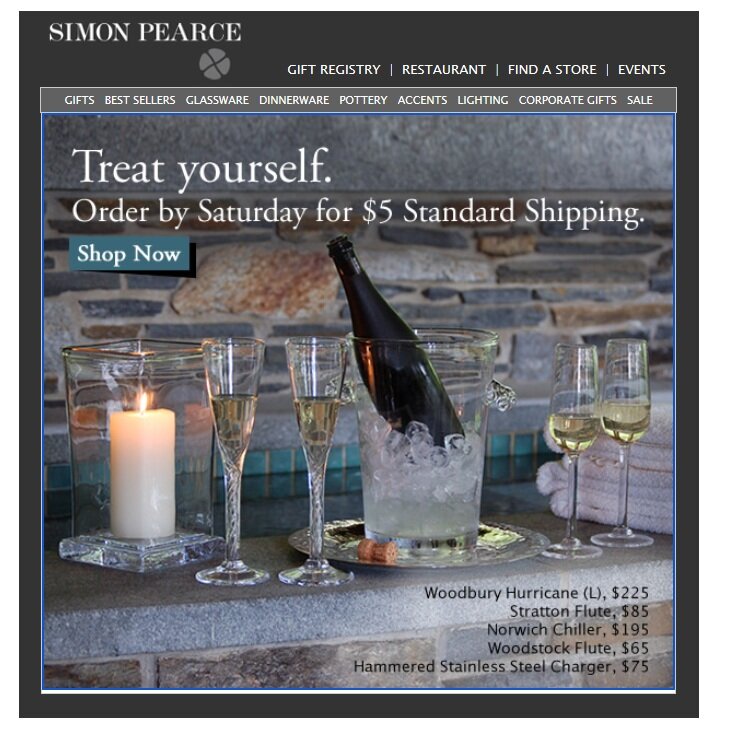

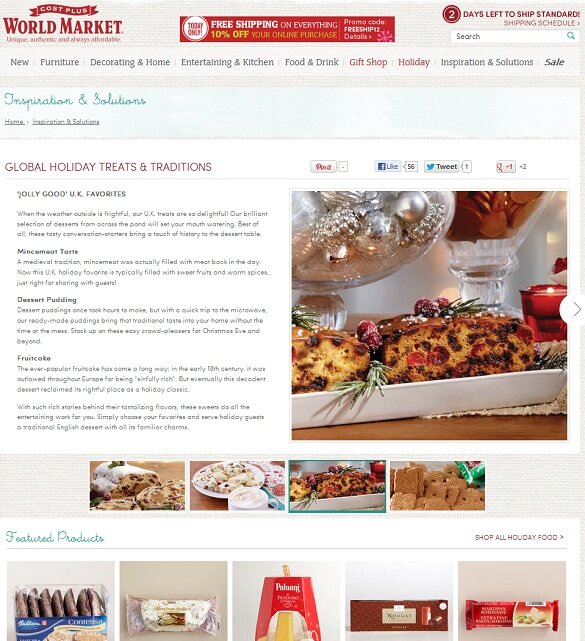

Experiment with ways to marry products and images. Merchants should seek to meld shopping with visual experiences at every turn. We’ve already touched on the emerging phenomenon of shoppable video, which enables shoppers to browse and select products as they’re featured in video content, but solutions also exist for still images, whether it’s an interactive look book that seamlessly marries a visual narrative with the opportunity to select and buy featured items, or individual images with embedded product information that can be displayed across touchpoints, such as when Levi’s used ThingLink during the 2012 holiday season to create links to product information. Brand followers on social networks could mouse over the image and view product links in a popup window.

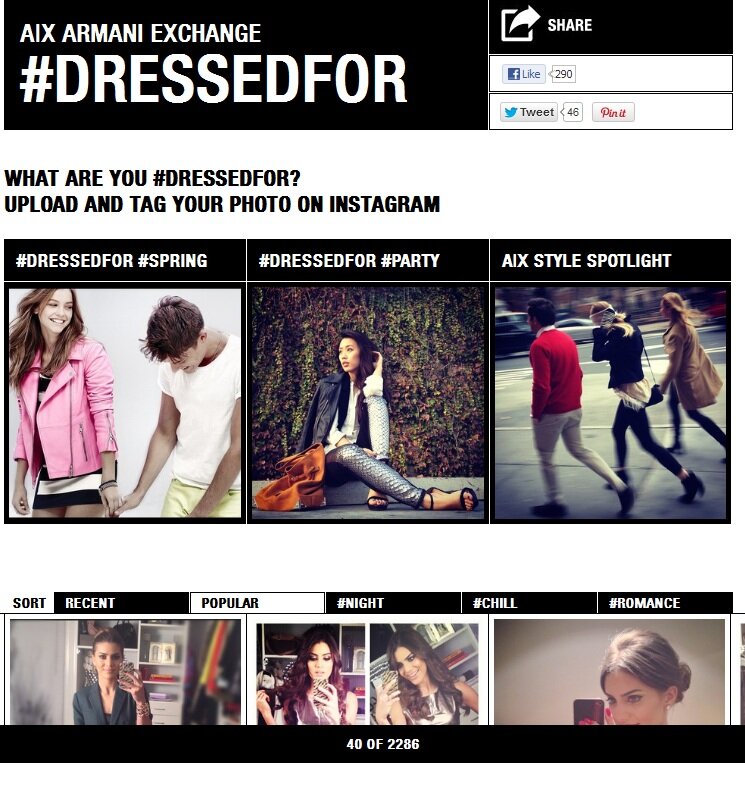

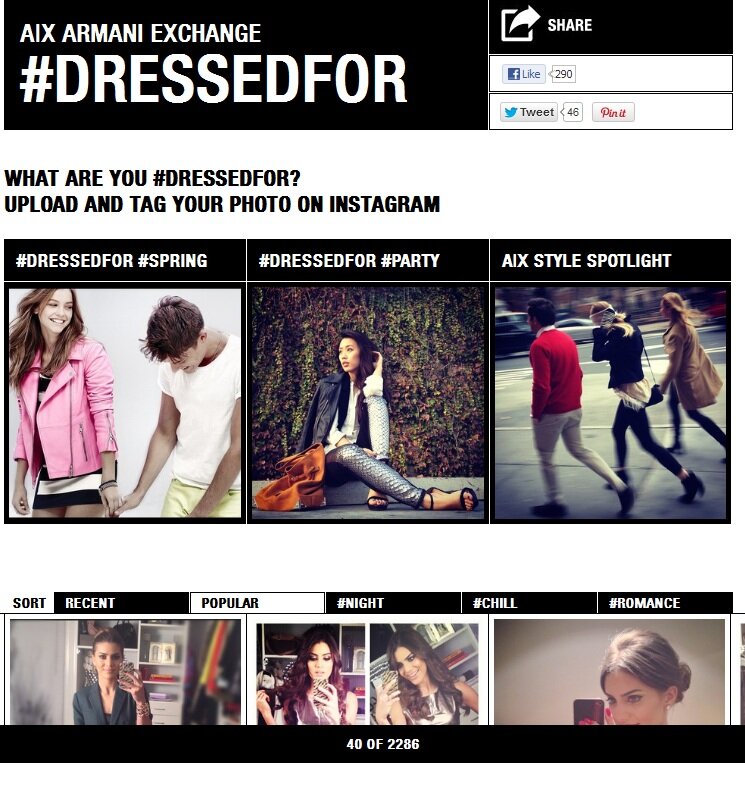

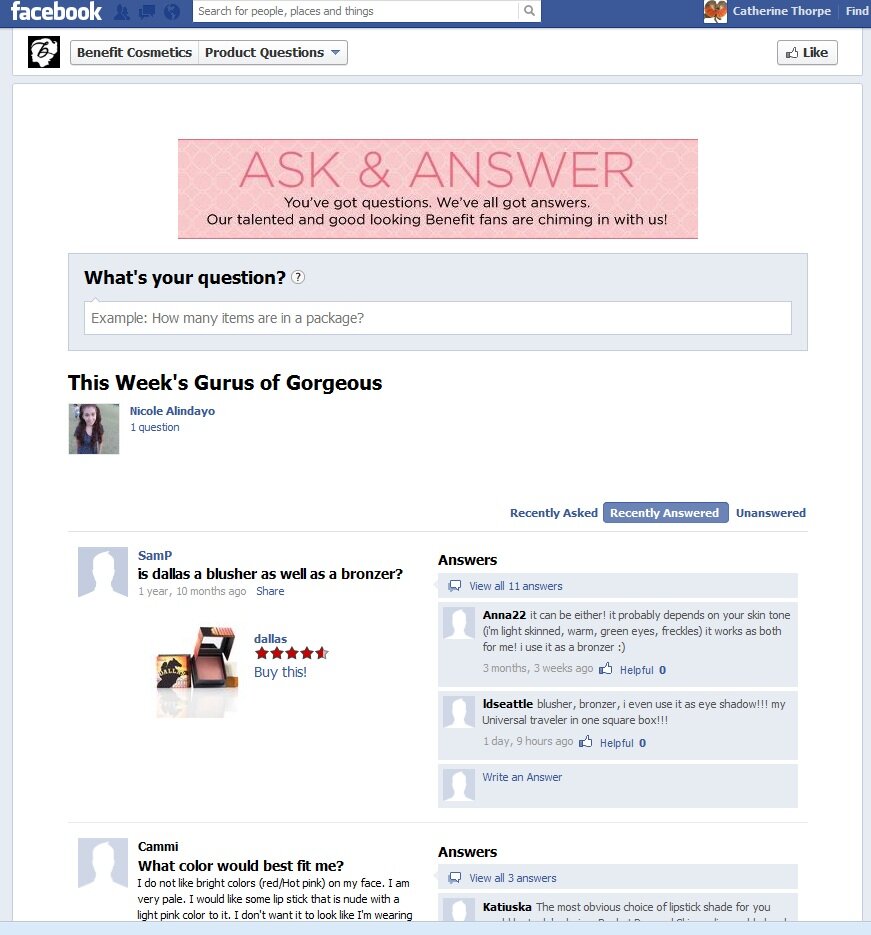

Tap into user-generated image potential. Whether or not merchants establish their own brand outposts on Pinterest or capture images using Instagram, they should find ways to tap the creative impulses of their brand followers. Prize contests or community recognition can provide the incentive to participate. The Armani Exchange Dressedfor.com site displays fashion photos uploaded to Instagram by brand followers, with contributions occasionally called out on the brand’s Twitter feed.

Use images to bring online offline. Merchants should seek new ways to draw consumers everywhere into the online experience, whether through QR codes in store displays or via product tie-ins on television shows. During New York Fashion Week early last year, L’Oreal offered free rides in taxis emblazoned with product images and scannable codes so that passengers could shop with their mobile phones en route to their destinations. The campaign reached fashion-obsessed consumers in a location conducive to shopping — what else is there to do in a cab stuck in traffic? One in three riders snapped a product image, according to SpyderLynk, which furnished the scannable tags.

How are you using images and video to enrich the shopping experience?

Connect with us: