Webinar recap: It’s not just the content — it’s what you do with it

March 15, 2013 Leave a Comment

Tuesday’s “Competing with Amazon” webinar dove deep into the topic of content, exploring how merchants can define and differentiate their brands through .

As MarketLive founder Ken Burke analyzed Amazon’s offerings and identified how merchants can go above and beyond to create unique brand experiences, an important subtext emerged: it’s not just the content itself, but what merchants do with it that matters. “If you build it, they will come” is a fine line for a movie script, but for merchants to maximize their content investments, they need to find creative ways to use content throughout the eCommerce site and across touchpoints. Just a few of the ideas the webinar discussed:

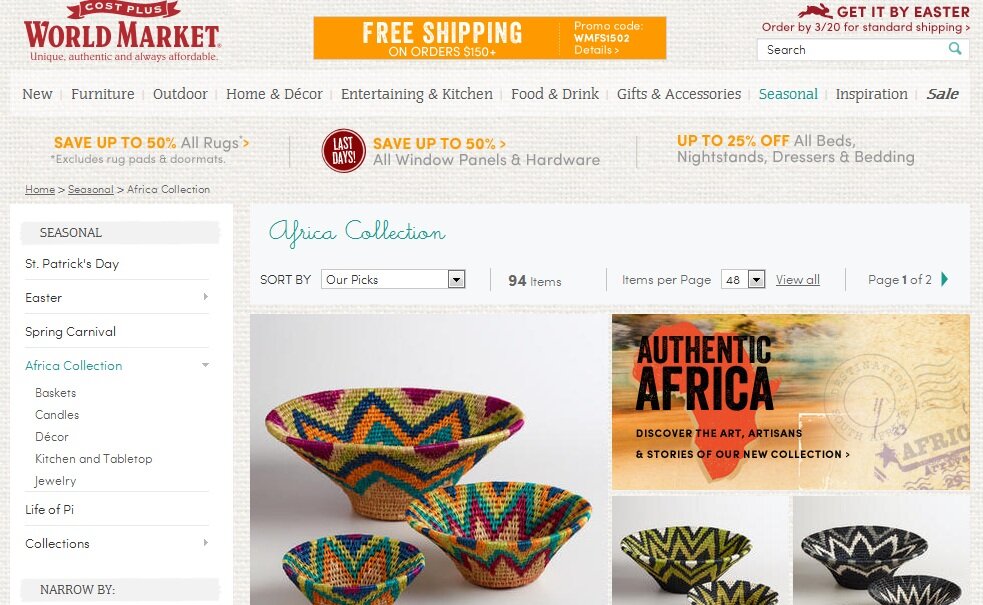

Merchandise product and lifestyle content. On the eCommerce site, merchants should promote content all along the path to purchase — not just on the product page or in siloed content sections. MarketLive merchant Cost Plus World Market showcases an in-depth content section about its Africa Collection not only on product pages, but on the home page and the category page.

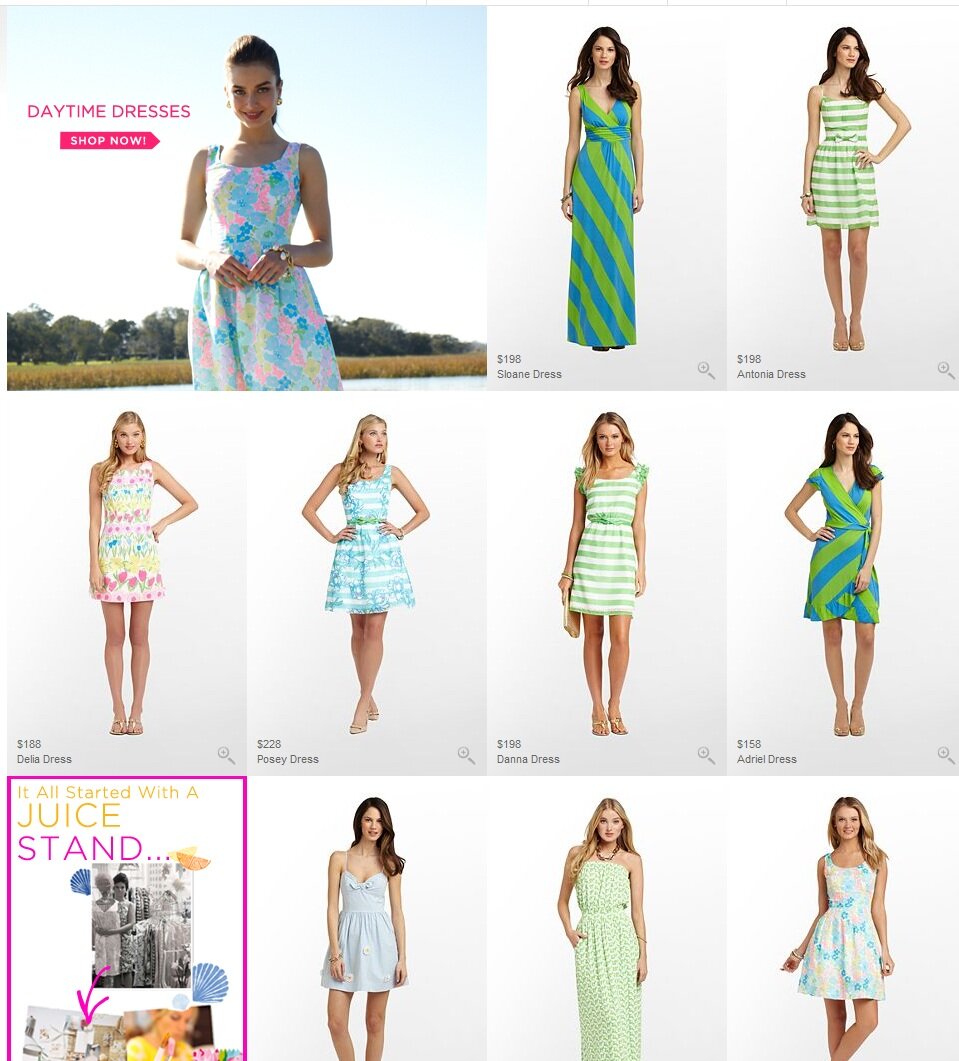

Similarly, apparel merchant Lilly Pulitzer includes a promotion of the company’s history on a product index page — enabling shoppers easy access to a compelling story that creates a personal connection with the brand.

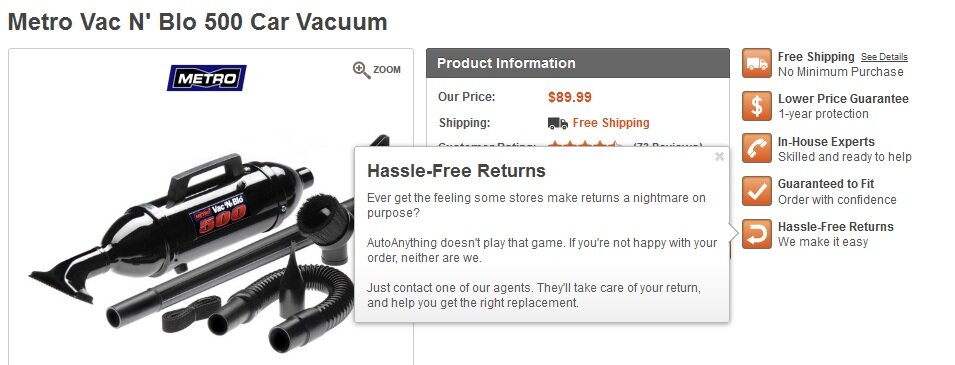

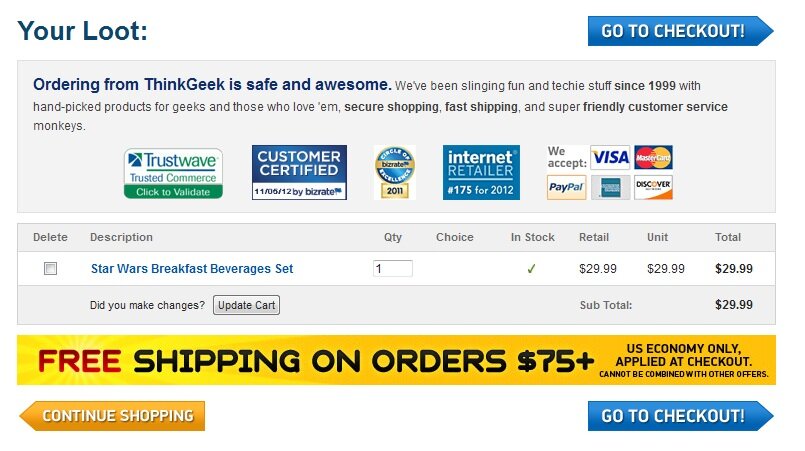

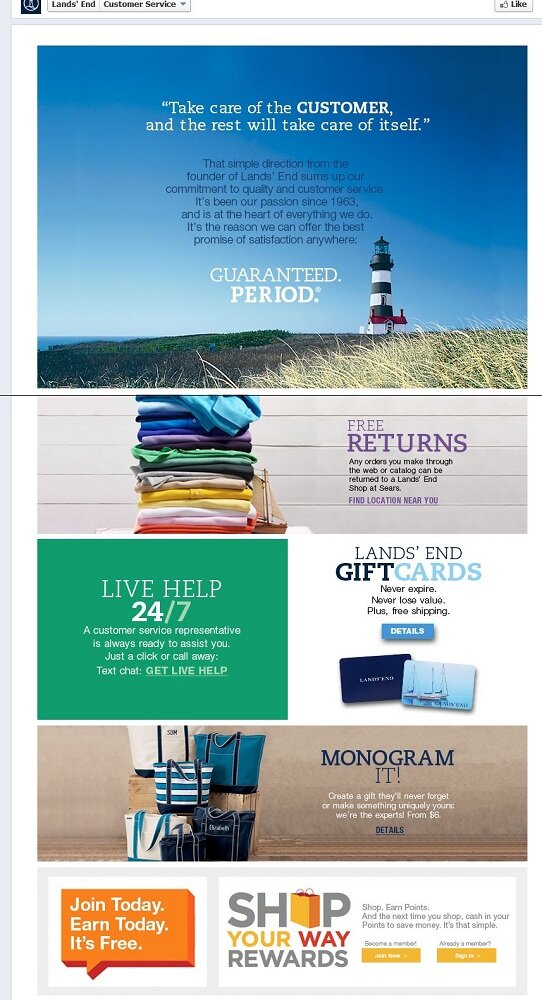

Share your brand value proposition everywhere. Merchants have long known the value of emphasizing their brand’s unique expertise, service and reputation, whether through a logo tagline or a compelling “about us” story. But merchants should find a way to share their brand’s core value statement on every page of the site — or at the very least on every product page, where shoppers can factor in the reputation of the merchant as they make their purchase decision. Auto parts merchant AutoAnything places an easy-to-scan list at the top of product pages, highlighting the expertise and service that back every product.

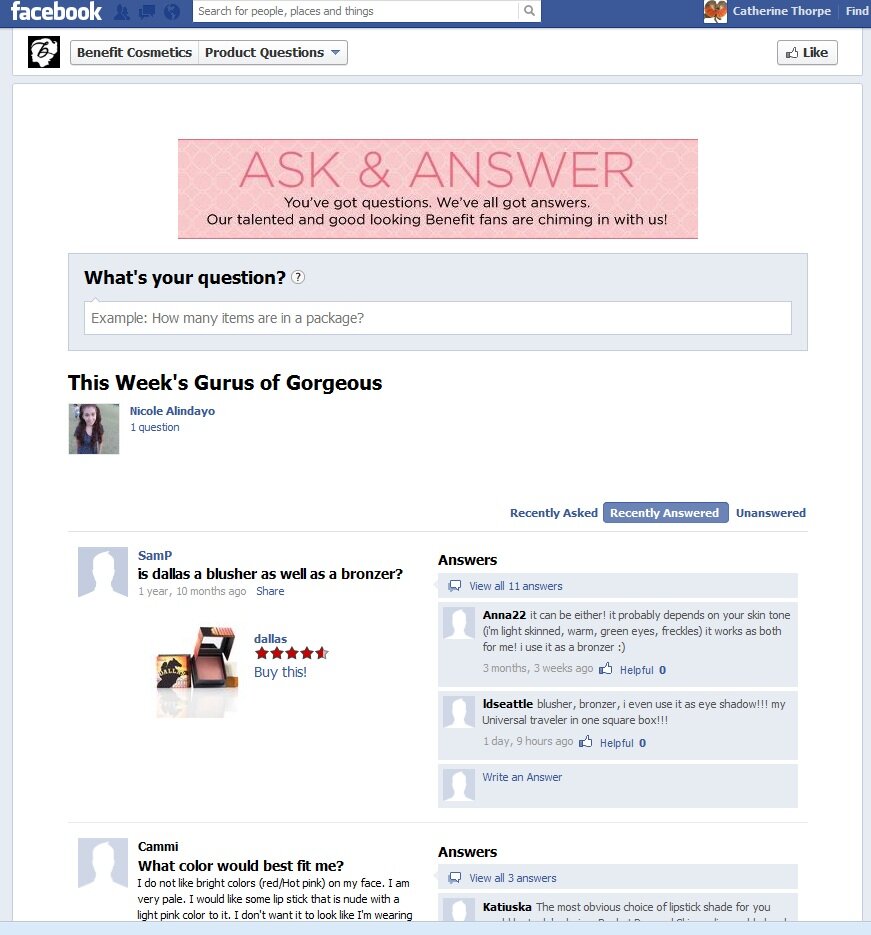

Do double duty with user-contributed content. Merchants should take advantage of tools that enable reviews and “question and answer” content to be cross-posted to Facebook and the eCommerce site — thereby elevating visibility of the features for social followers and encouraging participation across touchpoints. Benefit Cosmetics offers an “Ask and Answer” section on Facebook that allows followers as well as Benefit staff to chime in. Readers can rate contributions as well as submit their own; the questions and answers are displayed on the relevant product page of the eCommerce site as well as on Facebook. A question about a product called Dallas received 11 enthusiastic responses from customers, which were also displayed on the product page alongside nearly 100 reviews and ratings.

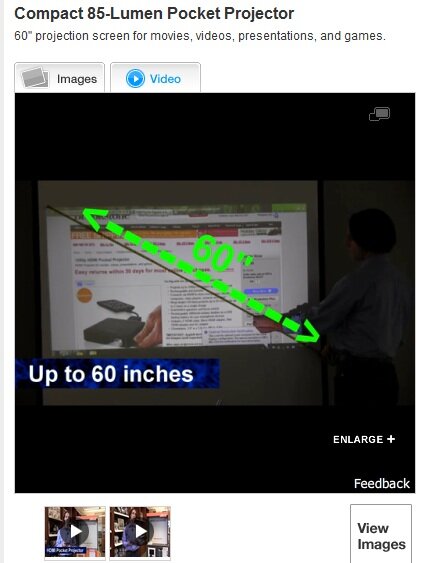

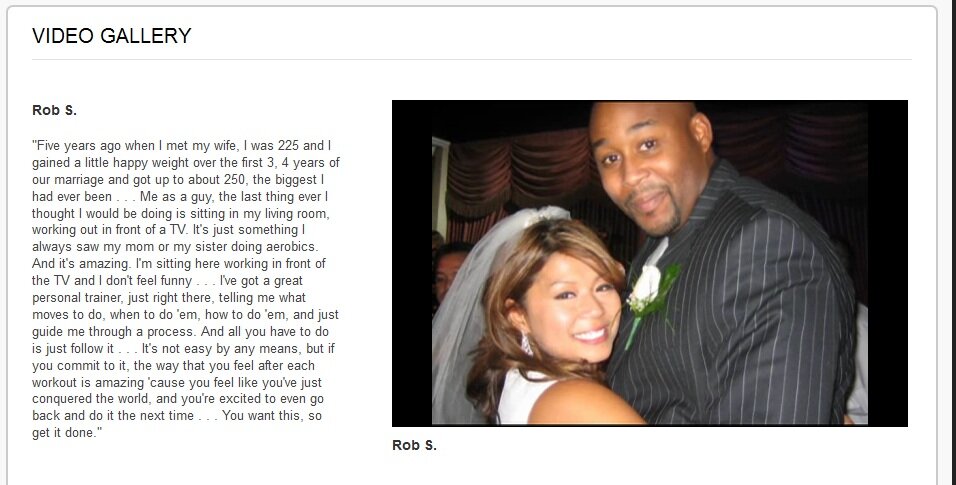

Give video star status. Given Amazon’s paltry video offerings, merchants would do well to adopt a “video first” strategy when it comes to developing content — and to highlight video content across touchpoints. On the product page, for example, video should be given equal prominence with still images, as on the Brookstone site, where a tabbed format gives product demonstration videos equal prominence with still images. A “Play” icon on the default image further signals that video is available.

And content that goes beyond product demonstration videos can make for a compelling experience across touchpoints. Buy.com’s weekly “BuyTV” program, spotlighting timely product categories such as Easter, attracts users not only to the main eCommerce site’s video content section, but on YouTube and Facebook as well.

For more winning content strategies and examples, replay the webinar or . How are you using content across touchpoints to increase brand engagement?

Timelines in email marketing. Add to the sense of urgency of the Free Shipping Day offer by displaying shipping cutoff dates as part of the marketing message, as Garden Botanika did last year by headlining its offer “Last Day”.

Timelines in email marketing. Add to the sense of urgency of the Free Shipping Day offer by displaying shipping cutoff dates as part of the marketing message, as Garden Botanika did last year by headlining its offer “Last Day”.

Connect with us: