Christmas in July: What to do now for holiday success

July 12, 2012 1 Comment

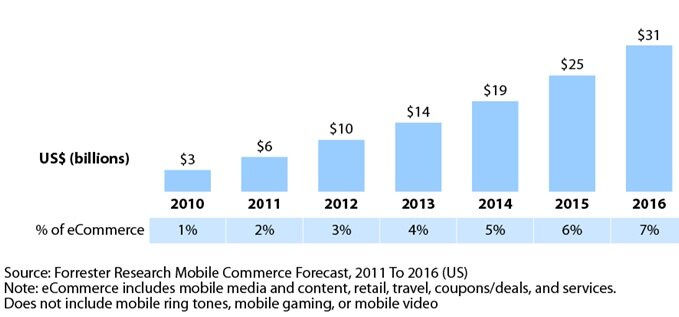

Now that the Fourth of July is in the rearview mirror, the end-of-year holiday season looms on the horizon — and for merchants, the stakes couldn’t be higher. Industry researcher Forrester estimates that from 2005 to 2011, online purchases have increased from 5% to 12% of total retail holiday sales — a 140% increase — and the growth trend is set to continue.

With so much at stake, merchants have been developing their fourth-quarter strategies all year and implementing the technology upgrades they need to remain competitive. While now is probably already too late to add to the list of major new features to devise, deploy and test before the holiday kickoff, there are a variety of site tweaks and marketing strategies merchants can undertake to maximize their chances of holiday success. Top priorities:

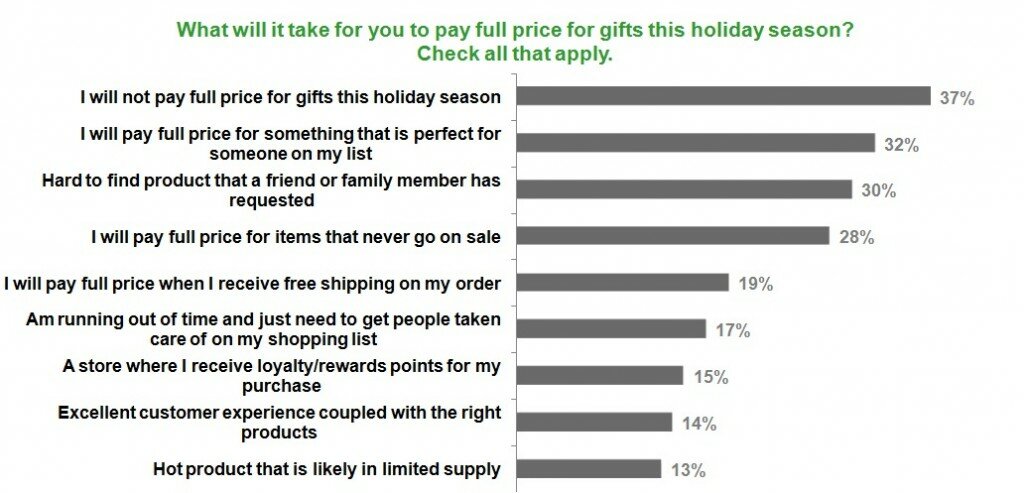

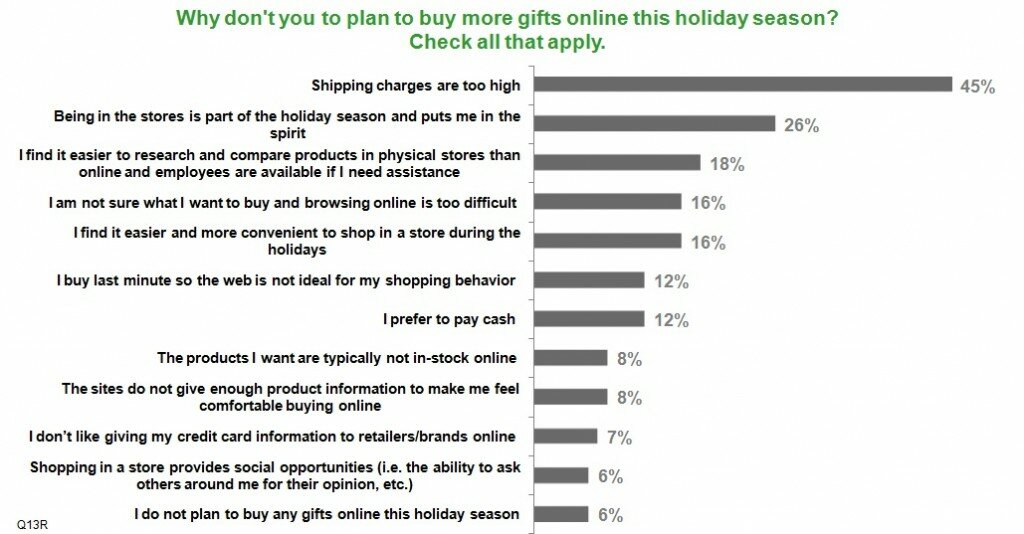

Run the numbers on season-long free shipping with no threshold — or formulate alternatives. Painful as its impact on the bottom line is for merchants to contemplate, free shipping with no threshold is a consumer favorite. In the 2011 MarketLive Consumer Shopping Survey, conducted just prior to the holiday season, 45% of participants said high shipping costs prevented them from buying more gifts online, and unconditional free shipping was the top-rated promotion shoppers said would influence their purchase decision.

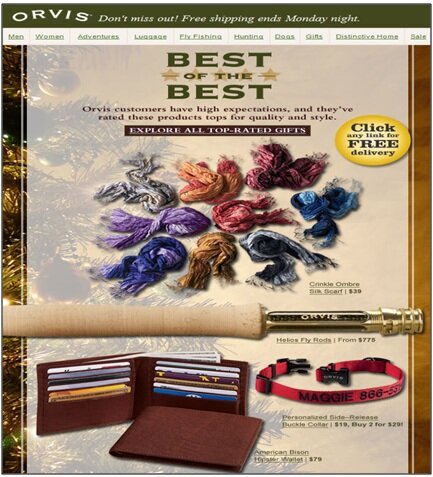

Because of its popularity, a handful of large brands now offer free shipping with no threshold year-round — upping consumers’ expectations still further. For most merchants, even offering it for the duration of the holiday season is an expensive proposition — but it’s worth contemplating for the competitive advantage it could afford your brand.

If you can’t offer free unconditional shipping for the duration of the season, consider offering it in small doses, such as:

- On red-letter shopping days. Black Friday, Cyber Monday, “Green Monday” (the second Monday in December) and Free Shipping Day to start.

- For limited time frames within a single day, such as night-owl, early-bird or lunch-hour specials.

- For loyalty club members only, or for customers with a high lifetime value.

Bedding company Cuddledown put a wry spin on a weekend-long shipping discount last year, saying “just please don’t tell our boss” that free shipping with no threshold was on offer.

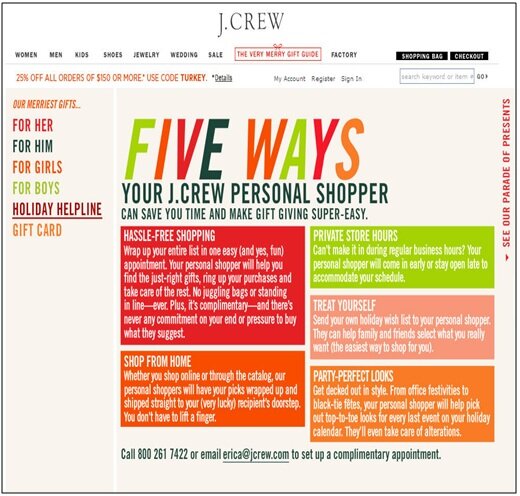

Beef up content. Offering holiday shoppers deep, relevant content can instill trust and help guide their gift purchases. In particular, in preparation for the peak season merchants should beef up content that helps shoppers:

- Research. Forrester estimates that in 2011, fully 36% of all purchases – not just online purchases – were influenced by the Web in some way, with product and brand research leading the list of online shopping behaviors. Merchants should provide a robust content toolset to assist potential gift buyers with their research.

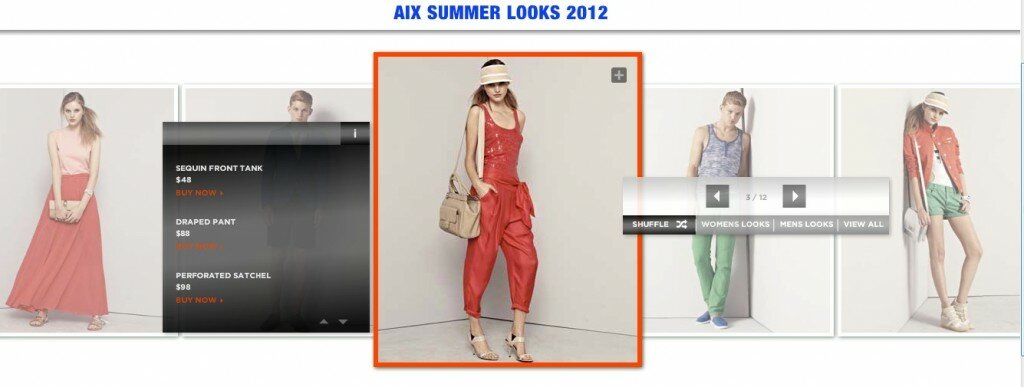

- Find gifts. Buying guides, product demonstration videos, and categories for top-rated items all help shoppers connect with the products that are just right for recipients on their list.

- Get help. Building comprehensive information to assist shoppers with their purchase decision demonstrates the credibility of the brand. And during the frantic holiday season, when shipping costs and delivery deadlines take center stage, robust customer service content is more important than ever.

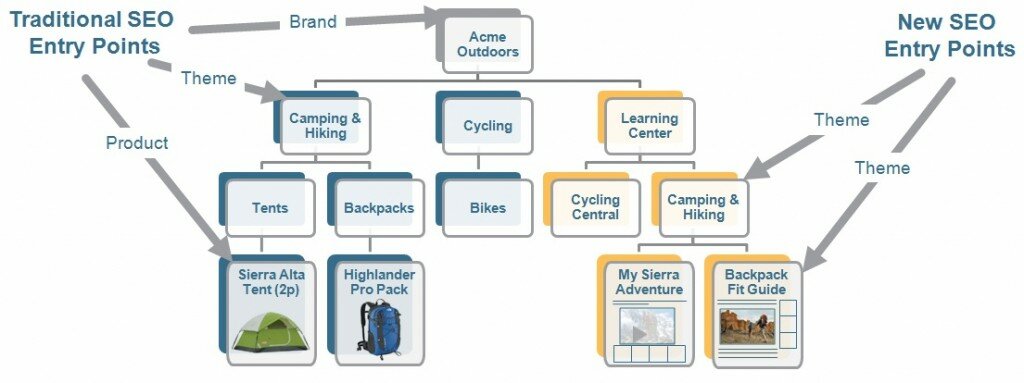

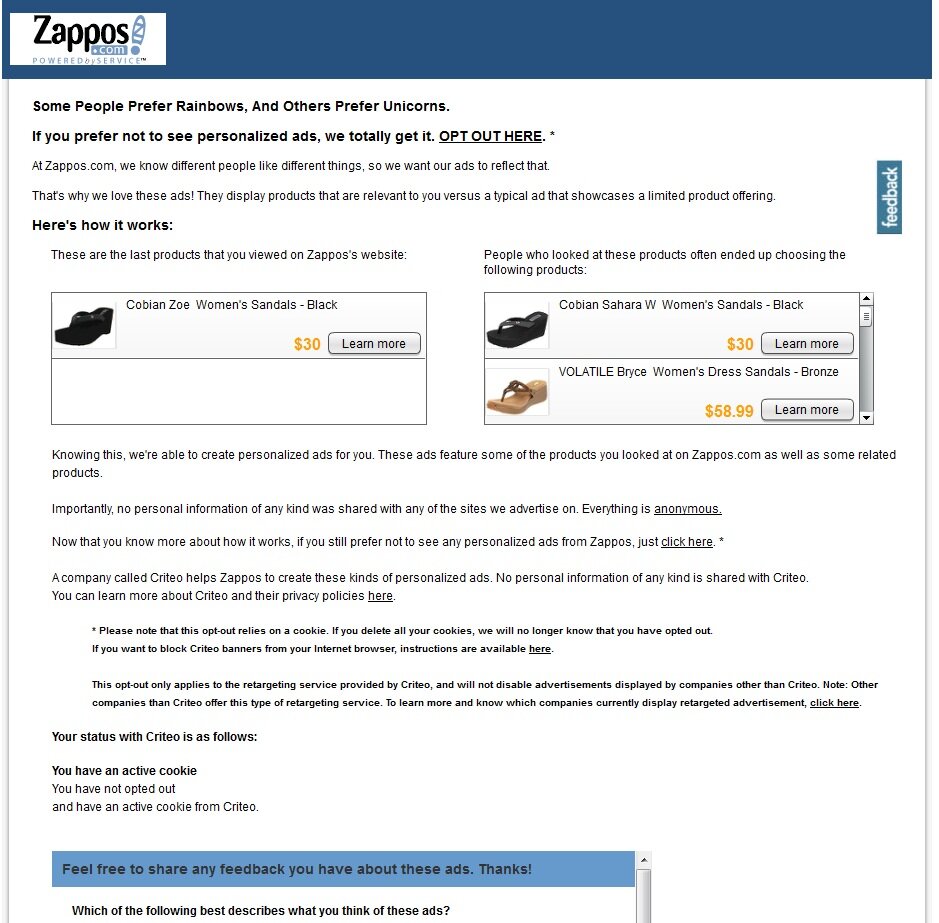

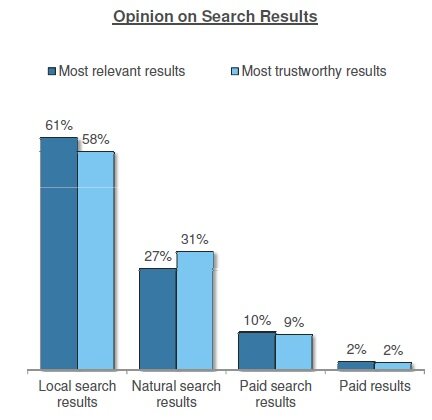

- Discover new pathways to purchase. In addition to providing fodder for consumers conducting product research, lifestyle content such as blog posts and articles can help boost merchants’ SEO rankings for non-branded terms, potentially bringing new audiences to the brand, as the graphic below illustrates.

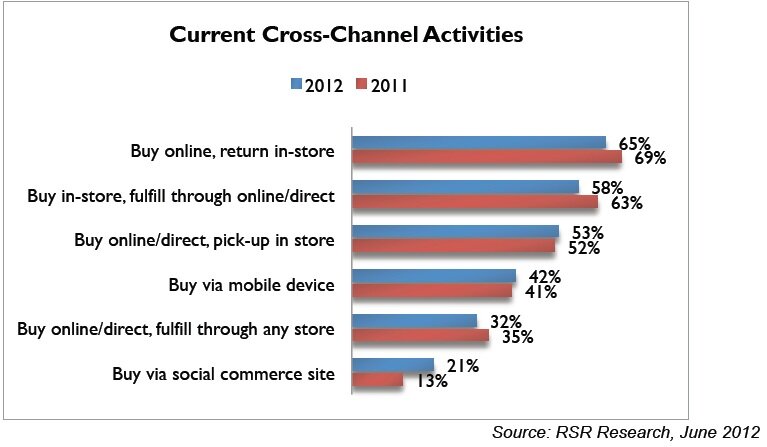

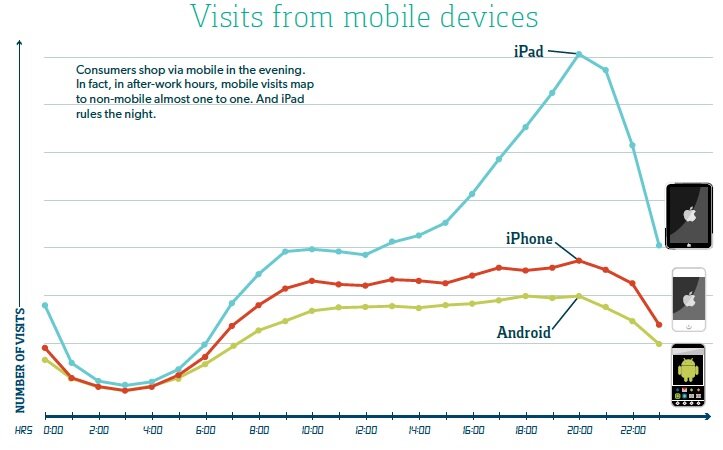

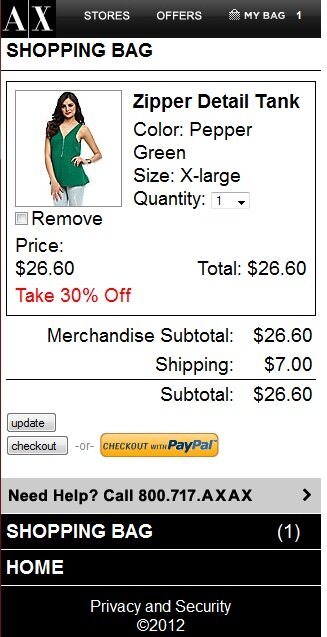

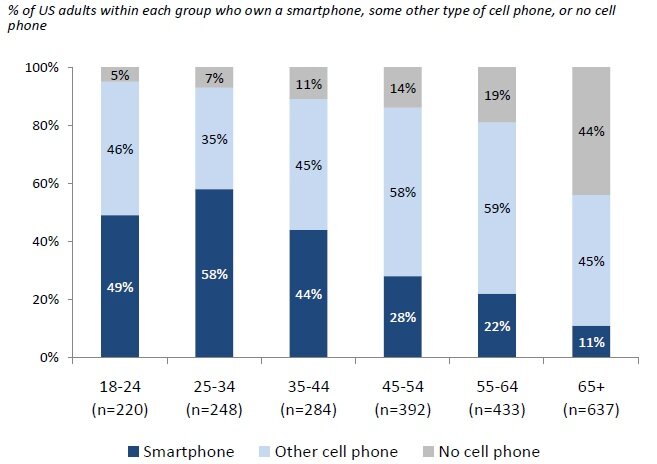

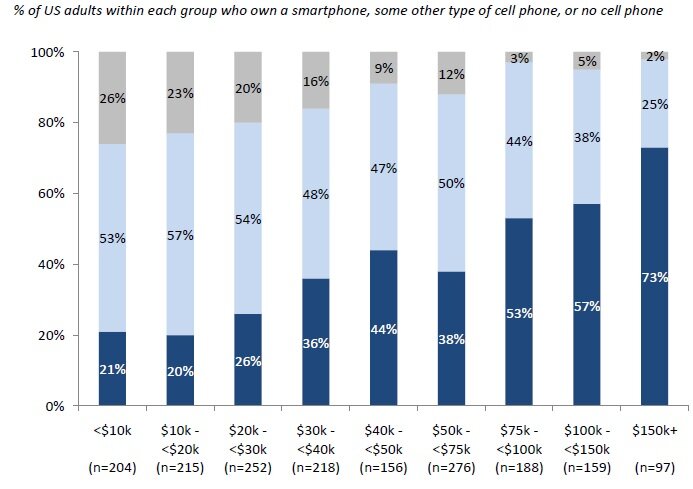

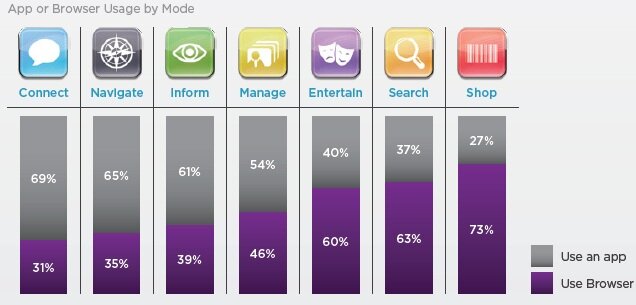

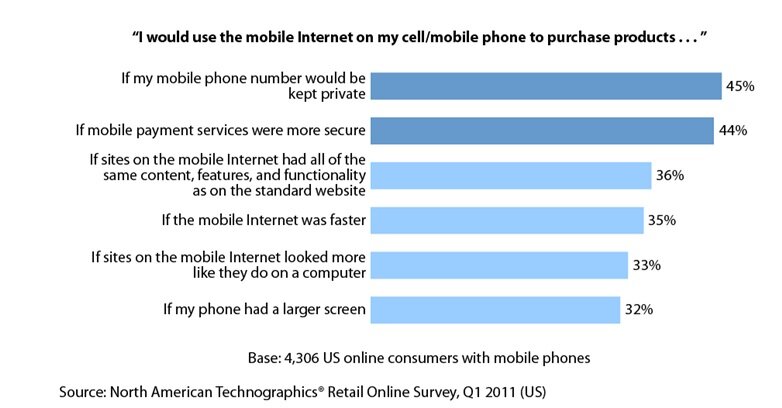

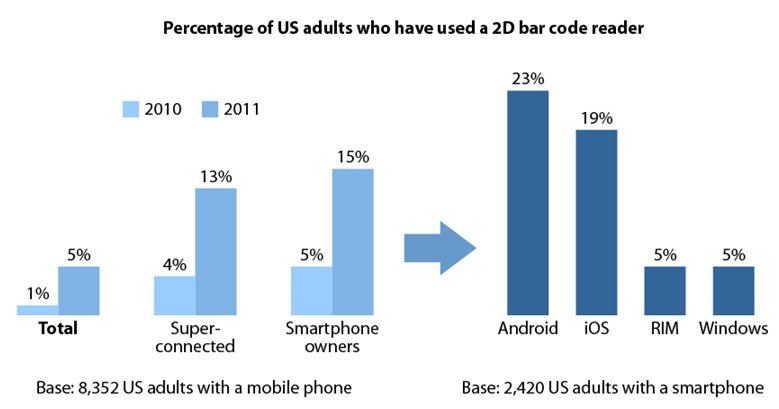

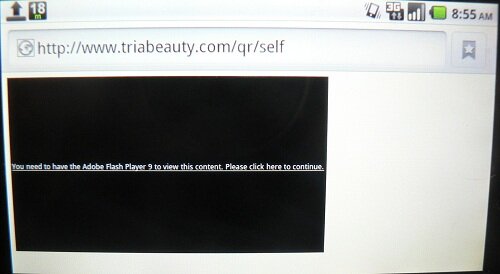

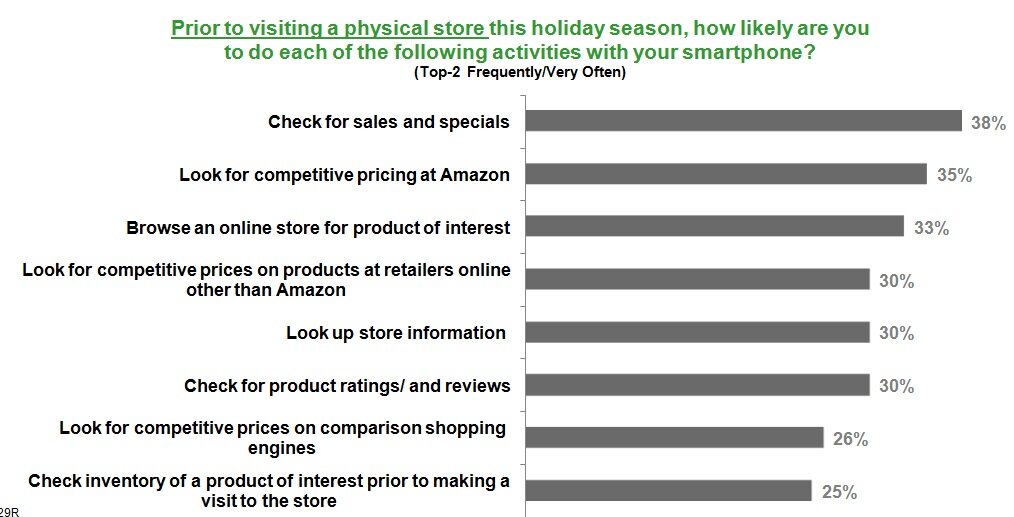

Add as much cross-channel mobile capability as you can support. Mobile research is likely to be prevalent this holiday season; last year, according to IBM Coremetrics, more than one in 10 shoppers used a mobile device to visit a merchant’s Web site on Cyber Monday, compared to 3.9% of shoppers in 2010 — a more than 175% increase.

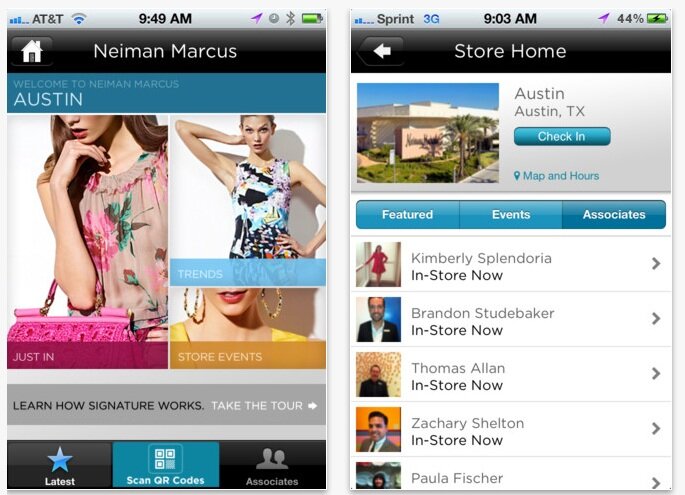

To cater to such behaviors, merchants should amp up their mobile offerings to include as much information about in-store activities as possible. In-store inventory integration is the ideal, but information that’s simpler to provide is also helpful to shoppers. Be sure to feature:

- A robust, up-to-date store locator. Make sure your store locator is set to display holiday hours, local phone numbers and integrated mapping for easy access to turn-by-turn directions.

- The skinny on store events and services. Special sales, in-store demos and gift wrap services are all relevant for holiday shoppers on the go.

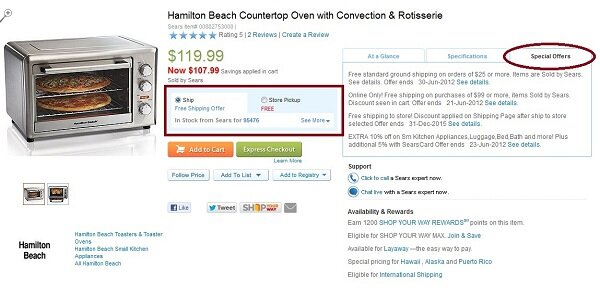

- Information on in-store pickup. Help connect online and offline touchpoints with prominent links to information about store delivery of items purchased online.

What holiday strategies are priorities for your business?

Connect with us: