It’s hard to believe, but the holiday season’s first official red-letter day — Black Friday, the day after Thanksgiving — is only a week away. Originally marking the kickoff of the holiday shopping season, Black Friday now merely represents the point at which seasonal messaging goes into hyperdrive for most merchants.

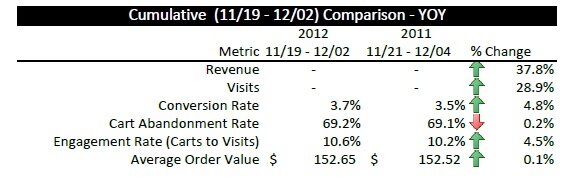

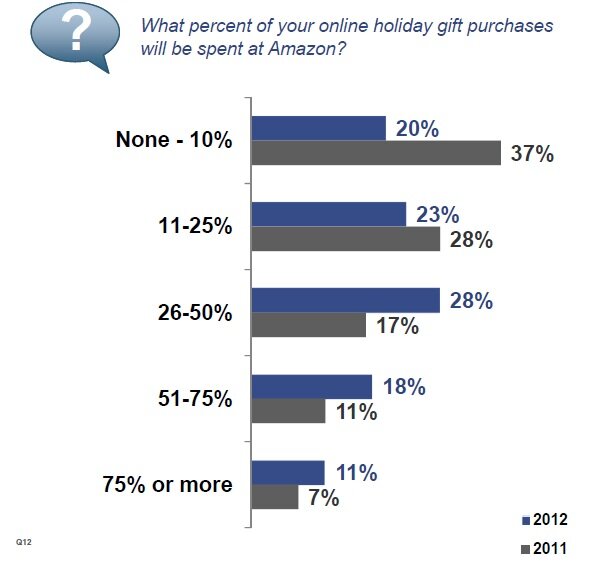

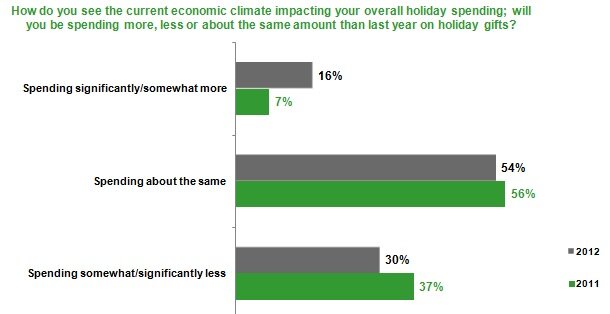

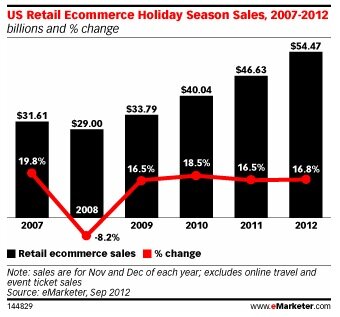

While forecasts project another blockbuster year for holiday sales growth, 54% of consumers report they’re planning to spend about the same as they did last year, according to the 2012 MarketLive Consumer Shopping Survey, which means holiday sales gains will be hard-won. No longer the highest revenue earner of the year — that honor goes to Cyber Monday, the Monday after Thanksgiving — Black Friday is nonetheless important as a harbinger for holiday sales performance. And since this year promises to bring a tough battle for shoppers’ attention and dollars, the stakes couldn’t be higher.

Of course, most merchants are already executing long-laid plans for winning holiday sales. But now that the clamor of seasonal promotions is actually underway, merchants should reexamine their campaigns and adapt as necessary to ensure their brand’s offerings are heard amidst the noise. Specifically, to kick off the season successfully, merchants should:

Begin Black Friday on Thanksgiving day — or sooner. Two out of five shoppers had already begun their gift purchasing in late October, according to Shop.org, and merchants have responded with pre-Black Friday deals. Amazon.com kicked off its “Countdown to Black Friday” November 1; Newegg.com is featuring deals all month with its “Black November” promotion. And next week, many major retailers, from Kmart to Kohls, will be open on Thanksgiving Day itself, sometimes beginning in the evening for a full 24 hours of hectic shopping.

At this point, online retailers not already offering pre-Black Friday deals should begin messaging their plans for the big event, stepping up marketing that:

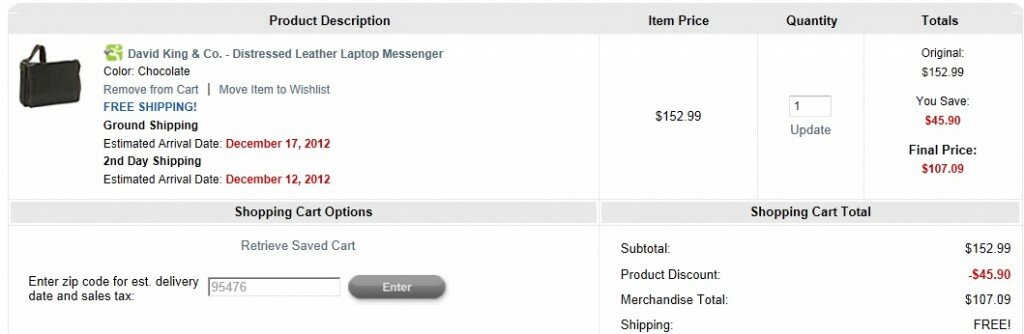

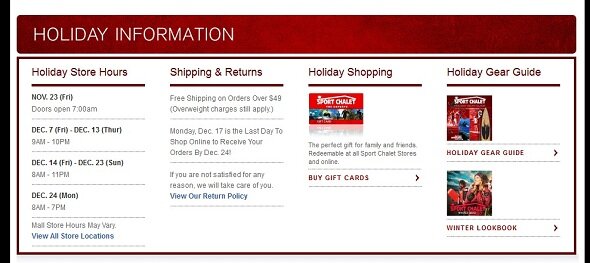

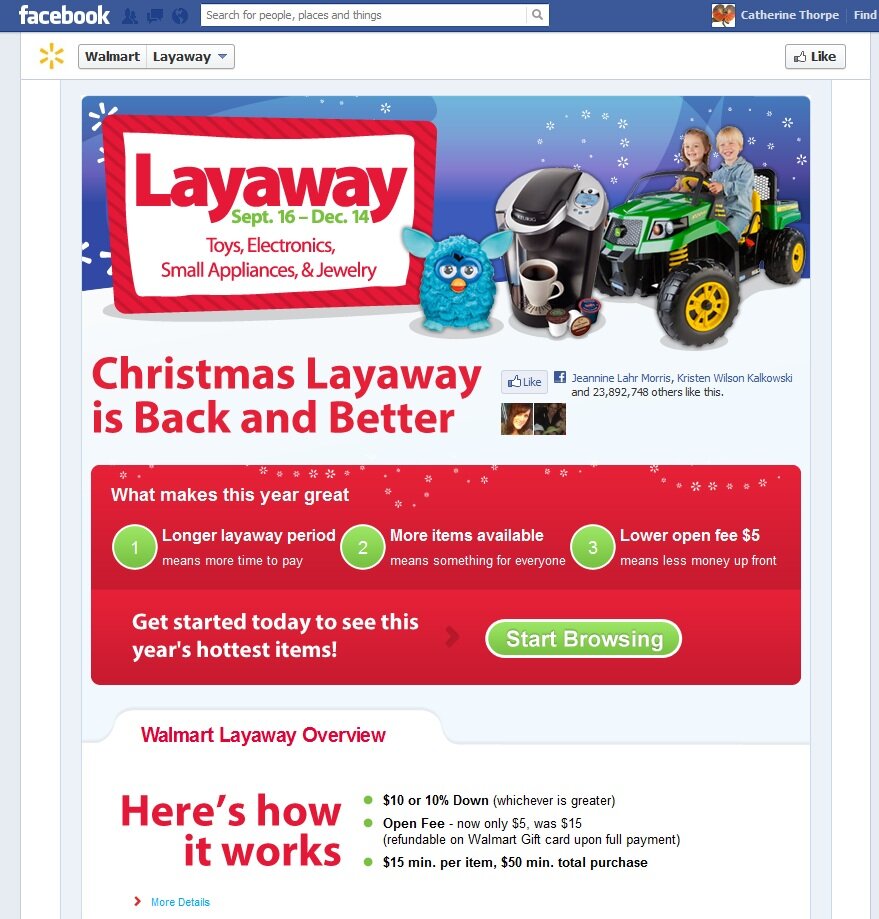

- Spells out hours and sets expectations for both online and offline shopping. Merchants should let shoppers know in advance customer service staffing hours for Thanksgiving week, including Thanksgiving Day, and merchants with physical store locations should prominently list store hours on the eCommerce site, social media outlets and in email campaigns.

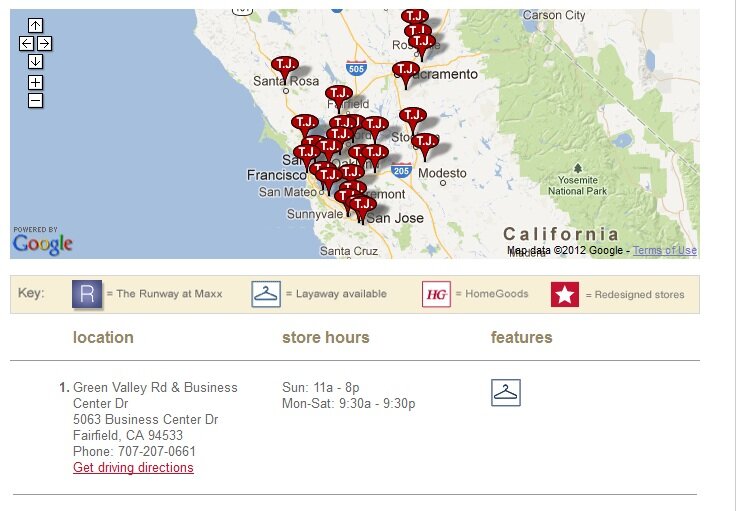

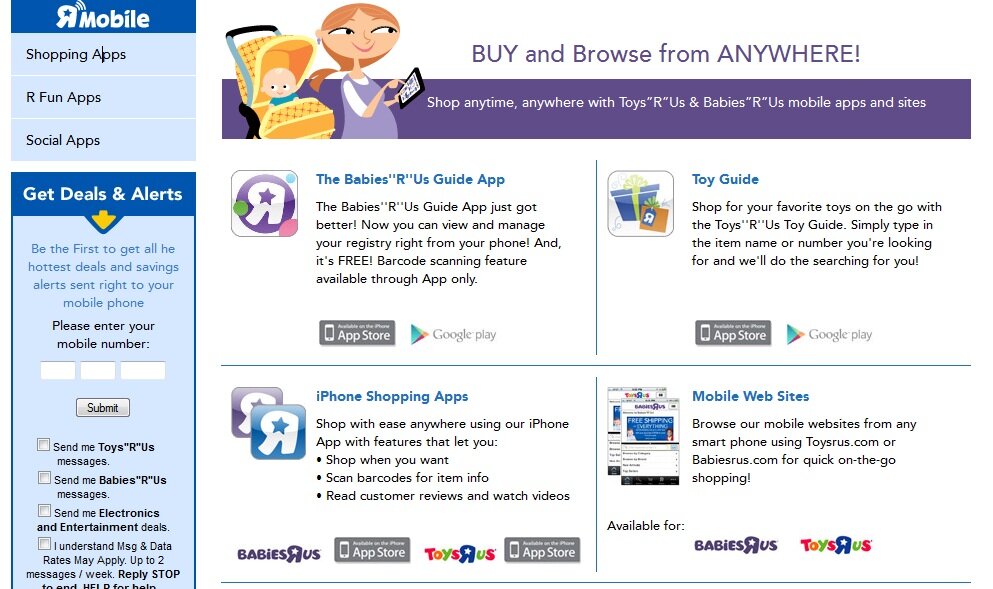

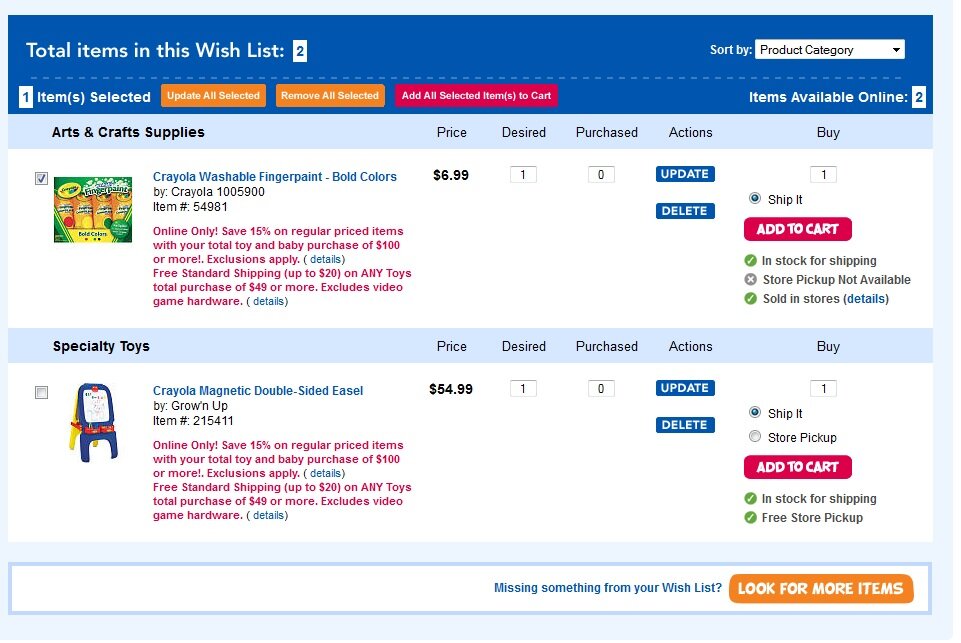

- Supports seamless online/in-store experiences. With shoppers researching deals on the computer before heading to stores, merchants should focus attention on connector points such as the store locator and any in-store pickup services they offer. This key Information should be available via mobile devices, which serve to bridge touchpoints for shoppers on the hunt for Black Friday bargains.

- Previews the upcoming deals. Give shoppers who’ve subscribed to email alerts or who follow the brand on social networks a sneak peak at upcoming sale items. And consider letting loyal customers have a first crack at purchasing Black Friday specials before everyone else early next week.

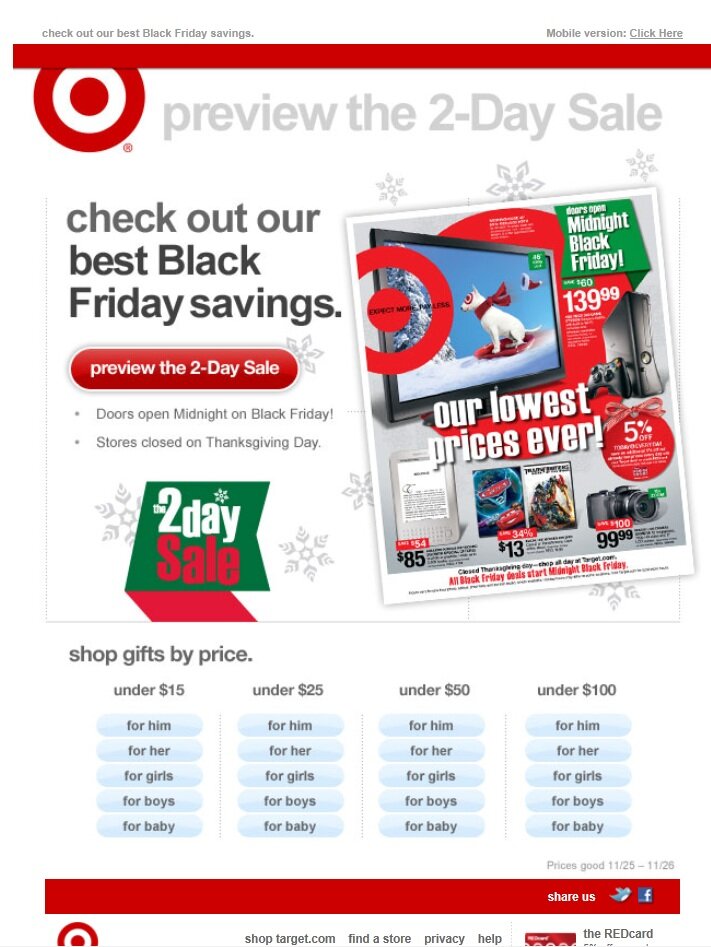

Last year, Target sent an email the Monday before Thanksgiving previewing sale items and showcasing its gift guide, organized by price. The email also prominently messaged the fact that stores would not be open Thanksgiving Day.

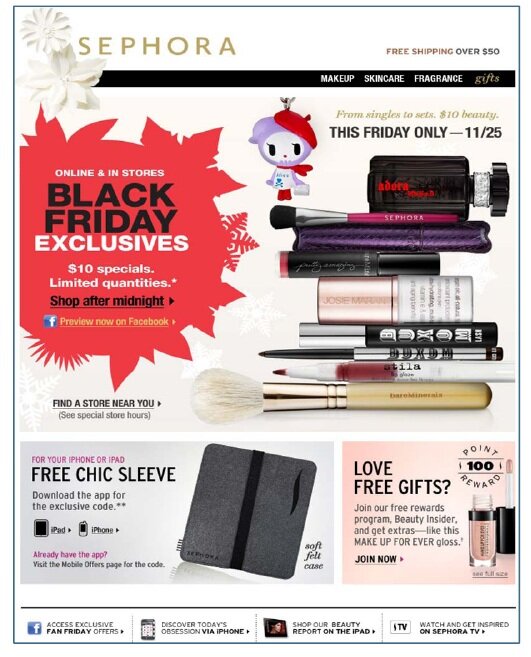

Promote sought-after items to boost commitment now … While shoppers are likely to crowd stores and begin browsing online as soon as doors open on Thanksgiving night, there will be plenty of holdouts, too, especially because this year’s calendar affords them an extra week between Thanksgiving and Christmas. The MarketLive Consumer Shopping Survey found that while more than a third of shoppers began their gift buying in September, fully 70% don’t anticipate finishing their gift lists until December. And online, shoppers can be tempted to wait and see if deals get better and if free shipping, the most popular online promotion, will be offered to suit their needs. To motivate these noncommittal browsers, merchants should put the spotlight on exclusives and hard-to-obtain items. To encourage purchasing on Black Friday itself, promote items that are unlikely to be available earlier in the season — from hot toys and electronics to exclusive items. Beauty merchant Sephora encouraged Black Friday spending with exclusive items priced competitively and available in limited quantities.

… and use daily deals to keep them coming back for more. With Black Friday kicking off a series of red-letter shopping days, merchants should use it as an opportunity to set expectations for more great deals to come. One way to do so, while also encouraging immediate purchases, is to adopt a “daily deal” strategy, showcasing a single item or discount each day throughout the Thanksgiving weekend and beyond. Such offers are popular with shoppers, 59% of whom used daily deal coupon sites such as Groupon or flash sale sites such as RueLaLa for holiday shopping last year, according to PriceGrabber.

To compete with those sites, and give shoppers plenty of reasons to buy now and keep returning later, merchants should devise a series of discounts and promote them prominently across touchpoints — from the eCommerce site to social media. Last year, the Gap promoted daily deals each day of the Thanksgiving weekend, in addition to its 60% discount. Specials included price cuts on popular items in-store and online and additional percent savings.

How do you plan to maximize the Black Friday opportunity?

Connect with us: