Tapping in to the daily deal mindset

February 29, 2012 Leave a Comment

With the number and popularity of daily deal sites on the rise, merchants are under pressure to play the discount game. But should they be?

There’s no doubt that voucher sites like Groupon and Living Social and flash-sale sites like RueLaLa, Gilt, HauteLook, Zulily and Woot! are grabbing headlines and changing savvy shoppers’ expectations. Whereas deep discounts used to be a feature of occasional, seasonal sale events offered directly by merchants, now consumers can find bargains from a number of sources year-round — in fact, subscribers to deal sites receive offers every single day.

With shoppers conditioned to hunt for low prices, merchants may feel that jumping on the discount bandwagon is inevitable. But there are reasons to take heart. First and foremost, daily deal sites have yet to catch on with a sizable segment of the population; industry researcher Forrester found that more than half of U.S. consumers had never used a voucher or flash-sale site. Of those who had, the actual purchase rate was low, with more than a third of voucher site subscribers and 47% of flash-sale site users saying they had never bought anything through those services.

Furthermore, the majority of consumers who did buy from deal sites reported that they were already familiar with the brands in question. And in the apparel, health and beauty, and home and garden categories, 54% of consumers on average stated that they would have bought the sale items even without the discount offer.

All of which is to day that daily deal sites are unlikely to single-handedly destroy merchant brands. At the same time, merchants stand to benefit if they borrow a few of the techniques that make daily deal sites so compelling — and the good news is that not all of them involve slashing prices. Consider:

1. Using rich product descriptions. Daily deal sites are curated with expertise to show products to their best advantage. Some sites, such as Woot, feature just one item daily, but with an extensive and witty description that compels buyers to click. For example, the description for the Home.Woot! example below presents a fictional scenario titled “The Breakup” of a man who has broken up with his girlfriend and must now clean the floor space left behind by her bookcase: “The Dyson DC33 Multi Floor Vacuum was hers, always had been. And it was gone, like her shelf, and her microwave, and her favorite mug, and her CD collection.” Below the main description, a long bulleted list gives shoppers all the product details in an easily-skimmable format that includes information about the warranty.

The lesson for merchants: Play up products with lush descriptions that speak to shoppers’ lifestyles. Include information about returns and product guarantees right on the product page, with easy links to customer service for more information.

2. Rewarding followers. Almost all flash-sale and voucher sites require shoppers to sign up for an account to receive access to the deep discounts on the site. New site visitors often have to be “invited” to join by someone with an existing account, creating a sense of belonging and exclusivity.

The lesson for merchants: While merchants shouldn’t force would-be buyers to create an account to complete purchases, they have existing customers, email subscribers and social network followers who can be rewarded with exclusive access to deep discounts. MarketLive merchant Title Nine sends its email subscribers a “WOW – Web-Only Wednesday” offer that features “one great deal, one day only” — much like a flash-sale site. The featured item in this example is more than 50% off, and the message reminds shoppers that quantities are limited as well as displaying more “steals and deals” for recipients to click.

3. Stressing scarcity & urgency. Flash sale sites often showcase hard-to-find items and rare deals — often with limited quantities available, giving shoppers incentive to buy immediately if they spot a bargain they like. And with the 24-hour timeframe built in to the daily deal model, there’s an innate sense of urgency, which sites highlight by displaying countdown clocks.

The lesson for merchants: Of course merchants should offer the ability to back order most products. But for final clearance items, discontinued sale items and one-time steep discounts, merchants can highlight the quantity remaining to motivate shoppers to act, as eBags does in this email promoting its clearance sale. Not only does the sale event have a deadline of Saturday, but each item on display in the message is tagged with the quantity remaining — giving the promotion double urgency.

Do you sell merchandise or vouchers via a daily deal site? Do you emulate their techniques?

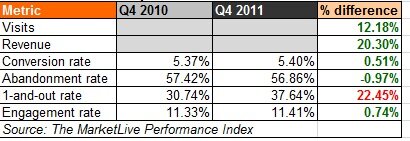

And, once again, it appears that the wealth wasn’t limited to major national brands and mass merchants. Year-over-year data from merchants listed in the MarketLive Performance Index in both 2010 and 2011 shows revenue gains of 20% for the fourth quarter — signaling that mid-market merchants thrived despite heavy competition and tight marketing budgets.

And, once again, it appears that the wealth wasn’t limited to major national brands and mass merchants. Year-over-year data from merchants listed in the MarketLive Performance Index in both 2010 and 2011 shows revenue gains of 20% for the fourth quarter — signaling that mid-market merchants thrived despite heavy competition and tight marketing budgets.

Connect with us: