Webinar recap: New analytics for a new world of commerce

March 26, 2012 Leave a Comment

We hope you caught Thursday’s presentation on optimizing analytics for connected commerce; it was an eye-opening look at how to capture and quantify the ever-more-complex interactions between consumers and brands. If you missed it, you can still visit MarketLive’s site for a replay download and whitepaper. A couple of the webinar’s key takeaways:

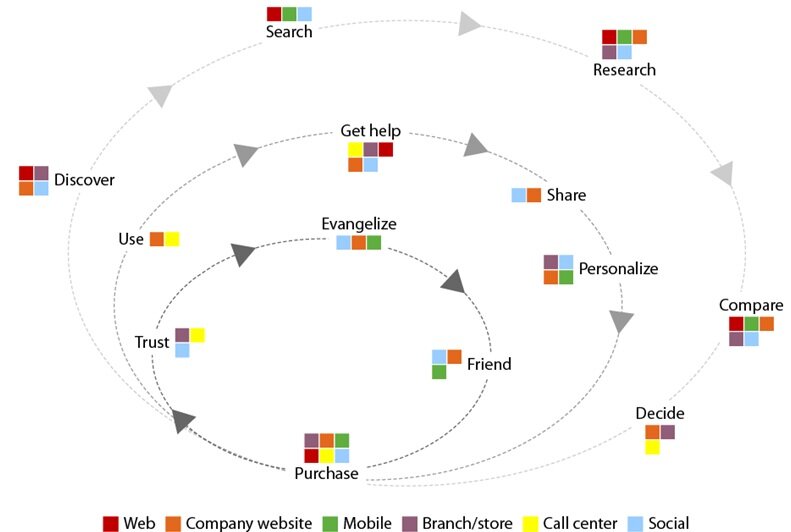

Web analytics reporting is just the beginning. With shoppers now roaming among eCommerce Web sites, mobile applications and social networks in their quest for products and brands to follow, merchants must compose a holistic view of consumer behavior — and that means moving beyond the Web analytics package to collect as much data as possible from wherever shoppers roam. In addition to email campaign metrics and paid search and banner tracking, merchants should take into account data from sources as diverse as:

- Customer support logs

- Loyalty card activity

- Point-of-sale data

- Social networks

Using common markers such as an email address can help connect the pieces of data to create a complete customer record that takes into account all their activities across touchpoints. MarketLive’s Kristi Burton noted that merchants should allay consumers’ privacy concerns about sharing data by stressing the benefits. For example, a point-of-sale cashier in a bricks-and-mortar store who requests an email address can explain that it will be used to help deliver better offers and product selection in the future, even if the shopper doesn’t elect to receive email alerts.

To use all that data, ask the right questions. Guest speaker Matt Hertig of Alight Analytics put it this way: Web reporting packages easily tell merchants “What happened?” — how many visitors clicked links and made purchases, which products garnered the most revenues, what pages had the highest “bounce” rates. But to gain sophisticated insight into consumer behavior, it’s key to move beyond these metrics to ask “Why did these actions occur?” and “What should I do next?”

Hertig demonstrated how dashboards tying together data from multiple sources, and segmented to focus on particular audiences, can answer those questions more precisely than eCommerce Web site analytics alone. For example, when MarketLive merchant Beauty Brands filtered traffic and revenue data to focus on mobile traffic and then segmented further by specific device, the metrics revealed that although iPad users accounted for less than 16% of mobile visits, they drove more than 60% of mobile revenue — suggesting that the answer to the question “What should I do next?” for Beauty Brands should include campaigns and messaging targeted toward tablet users.

Find new ways to define “conversion”, especially for social. With consumers’ path to purchase becoming ever more circuitous, it’s key for merchants to track completion of intermediary goals along the route. Actions such as signing up for email updates or setting up wish lists represent a stepped-up level of engagement with a brand that merchants should track.

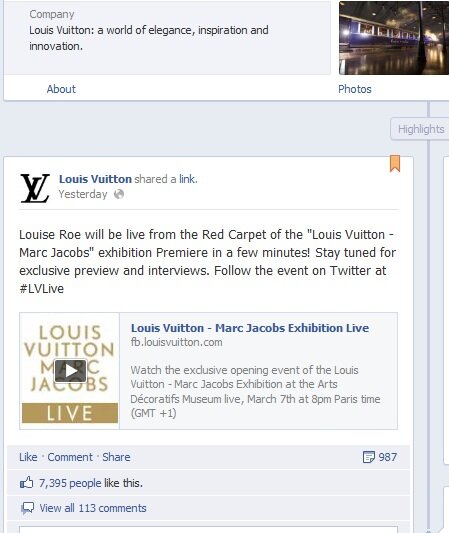

Specifically for social media, Hertig recommended defining goals that focus on driving brand awareness and engagement. He demonstrated a correlation between social interactions and site visits, which in turn drove revenues — showing that investment in creating social media buzz was indeed a worthy endeavor, creating a favorable first impression of the brand that led to increased sales.

The analytics Webinar was first in a series on optimizing your business in 2012 — watch for the next installment in May. Meantime, how are you using analytics to track customer behavior across touchpoints?

Connect with us: