The value of thinking long-term

April 30, 2013 Leave a Comment

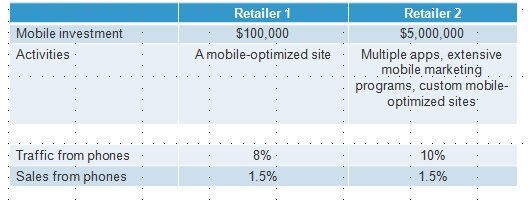

By now, merchants know that connecting with shoppers across touchpoints is crucial to their business — but quantifying the interaction of channels and and influences remains elusive. So it’s helpful to see new data from Google that shows just how important it is to maintain well-rounded, cohesive messaging. The interactive report “” parsed transactions from more than 35,000 sites using Google Analytics to demonstrate how a mix of influences convert shoppers to buyers.

Crucially, the report analyzed the length of the customer journey as well as the variety of touchpoints, and found that in retail, fully 50% of revenues are generated by purchases made over more than one day of interactions. Not only that, but a whopping two-thirds of revenues are generated by purchases that take place after more than one interaction — and the average order value for purchases rises as shoppers have more interactions with a brand. Compared with the average order value of a purchase made after one transaction, purchases made after about 10 interactions are 50% higher, and the average order value keeps rising (although incrementally) from there.

The data suggests that merchants need to rethink their messaging and strike a balance between enticing shoppers to buy immediately and building the long-term brand connection that pays off in the longer term. Among the strategies to consider:

Use “flash sale” style promotions wisely. The popularity of flash sale sites such as RueLaLa, Zulilly and Woot! has prompted retailers to tap into the daily-deal mindset with extremely limited-time offers that expire after a day or even just a few hours, often focusing on a single product. Such promotions can drive signups for email or mobile alerts on daily deal products and spur increased engagement with products on the Web site as shoppers are exposed to an array of fresh products. To encourage still further engagement across brand touchpoints, merchants should layer in longer-term messaging, using secondary positions in email promotions and on landing pages to encourage shoppers to keep coming back even if the featured discount doesn’t spor them to buy. Victoria’s Secret’s email promotion featuring a one-day sale on bikinis uses a secondary banner position to promote dollar-off discounts not tied to a particular product category, thereby appealing to shoppers not on the hunt for swimwear.

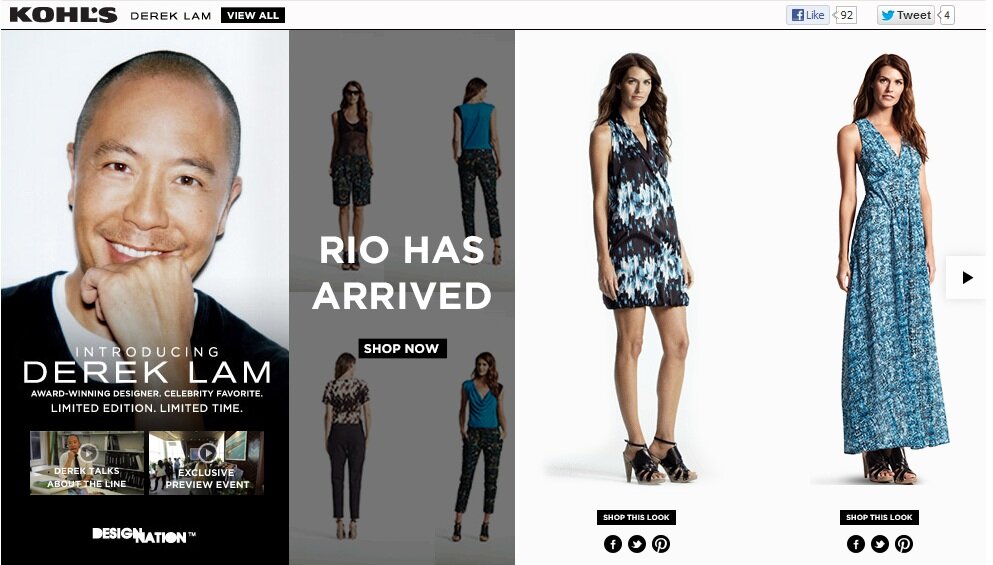

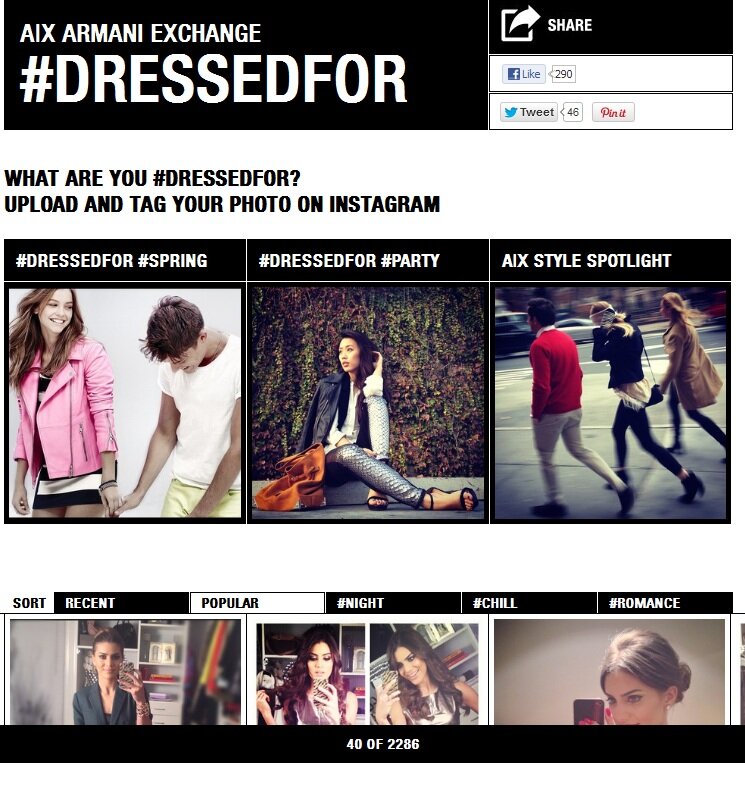

Use layers of social media interaction to spur long-term engagement and sales. Merchants should find ways to go beyond posting promo codes and product links to create a truly participatory experience for brand followers that leads inexorably to purchasing. American Eagle devised a months-long contest that spawned content across touchpoints and encouraged product browsing. Followers were first asked to vote for “real life” models for AE’s spring 2013 campaign on Facebook; the winners were featured in video profiles on the AE.com blog and their top product picks were displayed on Pinterest, leading followers to engage on multiple social platforms. Finally, those same contest winners appeared on the AE.com site as product models in shoppable collections.

How do you build long-term engagement with your brand?

Connect with us: