Striking a balance with marketplace selling

June 28, 2013 Leave a Comment

Merchants looking to make gains during the crucial holiday season would do well to consider optimizing their strategies for selling on third-party marketplaces. In addition to Amazon.com and eBay, a growing array of sites offer the opportunity for other merchants to sell their wares in exchange for a cut of the revenues. Even traditional retailers like Walmart.com are getting into the act, giving small- to mid-sized merchants a unique opportunity to leverage the platforms of some of the biggest online brands around.

At April’s MarketLive Summit, speaker Jordan Weinstein from ChannelAdvisor outlined the benefits of selling on third-party marketplaces. Among them:

-

Exposure to new audiences across the board. Weinstein cited a statistic from eBay claiming that 75% of a brand’s customers on third-party marketplaces are new acquisitions who hadn’t previously shopped with the brand. So while merchants may be reluctant to set up shop on platforms provided by ostensible competitors, they should weigh the benefits of such broad exposure against the potential risks.

-

Mobile visibility. Amazon and eBay attract the lion’s share of traffic to mobile commerce Web sites, according to data Weinstein shared from comScore. Since conducting product research across dozens of individual merchant sites can be unwieldy, and entering and saving payment information on Amazon and eBay is simpler than entering credit card data over and over again, it’s no wonder that consumer prefer these clearinghouses when using their smartphones.

DFF

-

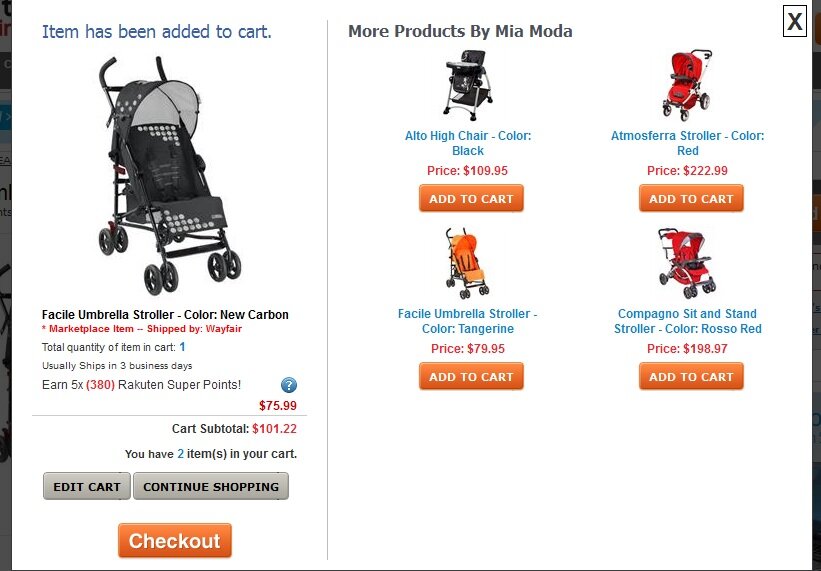

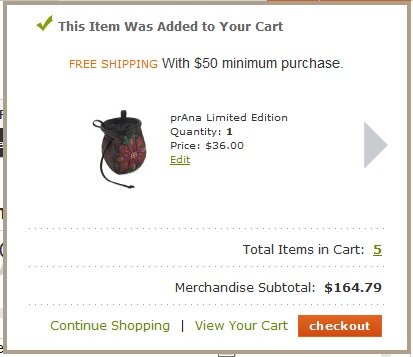

Search visibility. As discussed in our prior post, merchants who struggle to break onto the first page of natural search listings can leverage the likelihood that big brands such as Amazon and Rakuten will rank well to gain exposure.

-

A foot in the door to international markets. As leading shopping destinations worldwide, Amazon and eBay represent a relatively hassle-free way to explore the potential of international expansion.

Of course, just because marketplace selling can be a smart strategy doesn’t mean it’s easy; merchants should dedicate staff resources to managing their marketplace presences, or hire outside help in the form of marketplace agency firms. And to strike the right balance, merchants must make a series of tradeoffs so that they take advantage of the marketplace platform without diluting their brands. Factors to weigh:

Marketplace size. While in theory the broadest exposure may come on giant marketplace networks such as Amazon and eBay, merchants may have a hard time competing for visibility with other marketplace sellers, even for products they manufacture themselves. And since owning the prime position or “buy” button is crucial for marketplace success, in some cases merchants would do well to establish a presence on smaller marketplace sites where their chances of visibility are better. OJ Commerce, which sells sporting goods, offers a women’s Schwinn bike on Amazon, but doesn’t event show up in the “other buying choices” box on the product page, where the default option is to buy from Amazon.com itself. On NewEgg, however, OJ Commerce is the sole and default seller of the item.

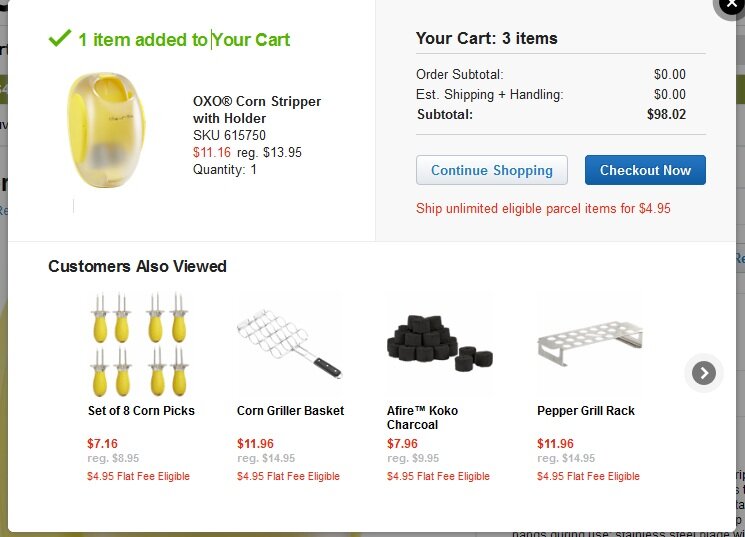

Popular vs. unique products. Merchants should select their product mix with an eye toward visibility. While consumers are more likely to search for top brand-name items on marketplace sites, merchants may stand a better chance of prominent positioning with unique products, including gift packs and sets. Additionally, merchants should tweak their product offering from marketplace to marketplace depending on the amount of competition they face for top items. For example, in Amazon’s baby care section, 13 merchants are vying to sell a lotion from manufacturer California Baby, while just 4 are listed for a gift set that includes the lotion along with other essentials.

Customer service and fulfillment investment. Much like the formula behind Google’s natural search algorithm, the precise calculations that determine which merchant wins placement in the coveted “buy” box on Amazon or a top listing on eBay are not divulged publicly. But and eBay’s best practices documentation indicates that seller reputation is a big part of the equation, suggesting that merchants must be prepared to answer questions promptly, fulfill orders swiftly and accurately and otherwise invest in ensuring a smooth and satisfactory experience for marketplace shoppers. Merchants without infinite budgets must weigh how best to focus their investments to both achieve stellar marketplace status and optimize their core eCommerce offerings.

Does your brand sell via third-party marketplaces, and if so, which ones?

Connect with us: