2 considerations for attracting tablet shoppers

May 30, 2012 Leave a Comment

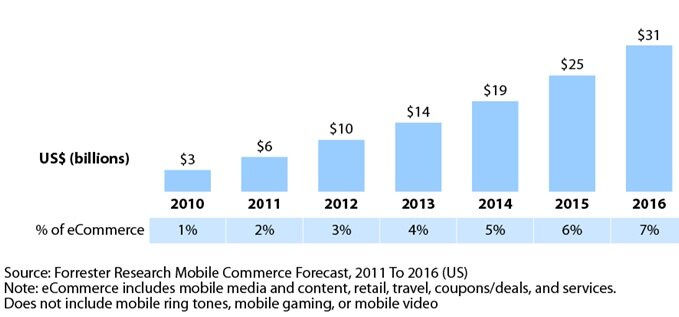

Last week brought more evidence that mobile is changing the way consumers shop — with tablets playing an especially lucrative role. According to initial results from the 2012 State of Retailing Online study by Shop.org and Forrester Research, 49% of retailers reported that average order value from tablet customers was higher than on the traditional browser-based eCommerce site.

While the tablet market is still relatively small, it’s growing fast, with nearly 38 million U.S. consumers forecast to own one by year’s end — a more than 250% increase since the tablet first came into existence a mere two years ago. The new Shop.org study data is in line with earlier research suggesting that these technology early adopters are well-educated, affluent, and more likely to use their devices to buy than smartphone owners.

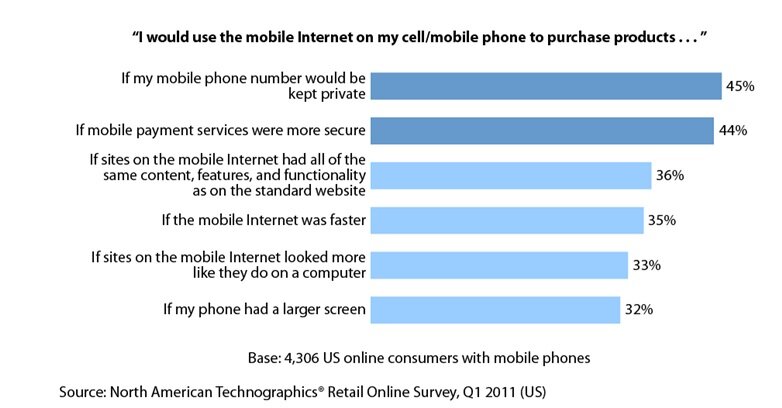

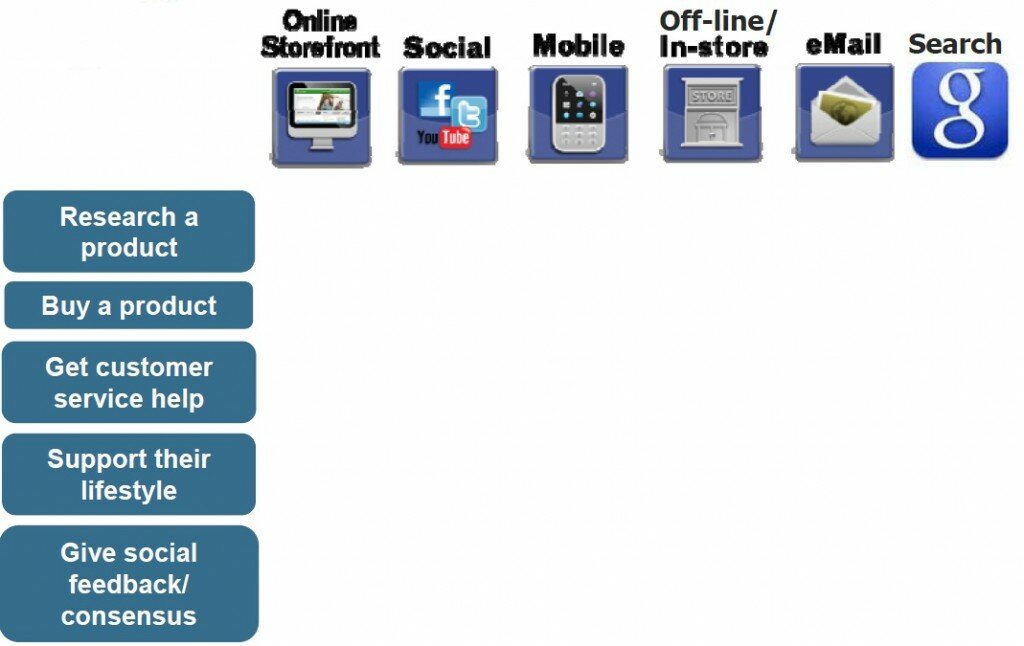

For retailers, the new data underscores the importance of mobile as a game-changing mode of shopping — and the need to develop and execute a sound mobile strategy. As we’ve stated previously, whether to target tablet shoppers right now depends on your business and your target audience; research is key to devising a mobile strategy that will serve shoppers best and drive sales most efficiently.

Assuming tablet shoppers form an important target market for your brand, weigh these considerations as you formulate your mobile strategy:

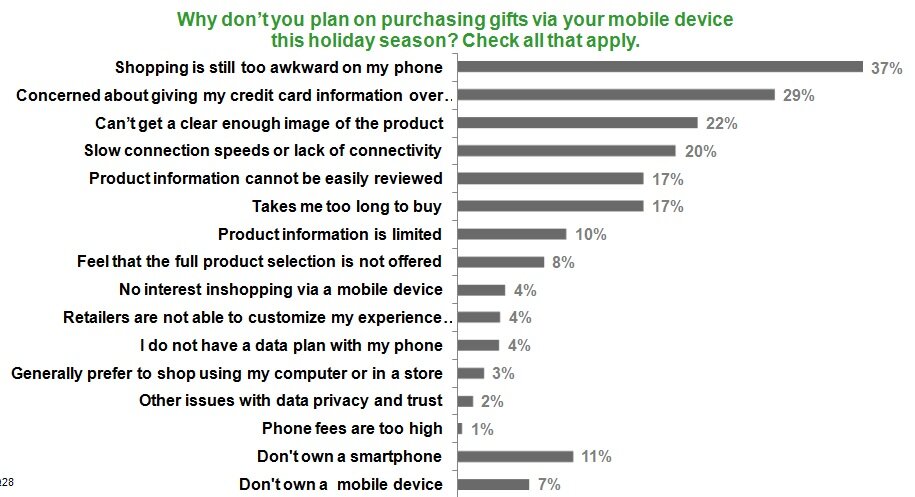

Design for swipes and taps as well as clicks. With shopping content being deployed across smartphone devices as well as tablets and desktop browsers, flexibility of presentation is key. And don’t forget email; according to the Shop.org report, one in five emails are viewed on a mobile device. Specifically for tablets, consider these elements:

- “Landscape” or “portrait”? Like on smartphones, tablet shoppers have the ability to swivel views of content horizontally or vertically — but the impact is especially dramatic on tablets’ larger screens. Adaptive designs that adjust to the width of the viewer window automatically are best.

- Tappable menus. Drop-down menus shoppers hover over with a computer mouse before clicking to select a sub-category need modification for tablets, which have no “hover” equivalent. Set menus so that a tap displays the drop-down menu.

- Appropriate text size and spacing. As with smartphone displays, easy selection of the right menu item or text link is crucial, so allow for adequate space to accommodate finger taps.

- Think swipe. Take advantage of the ability to page horizontally through content with filmstrip displays and plenty of “forward” and “back” arrows. MarketLive merchant Armani Exchange’s “Looks” section works equally well on desktop browsers and iPads, with a “shuffle” button reminiscent of an Apple music player that presents ensembles for both genders in random order.

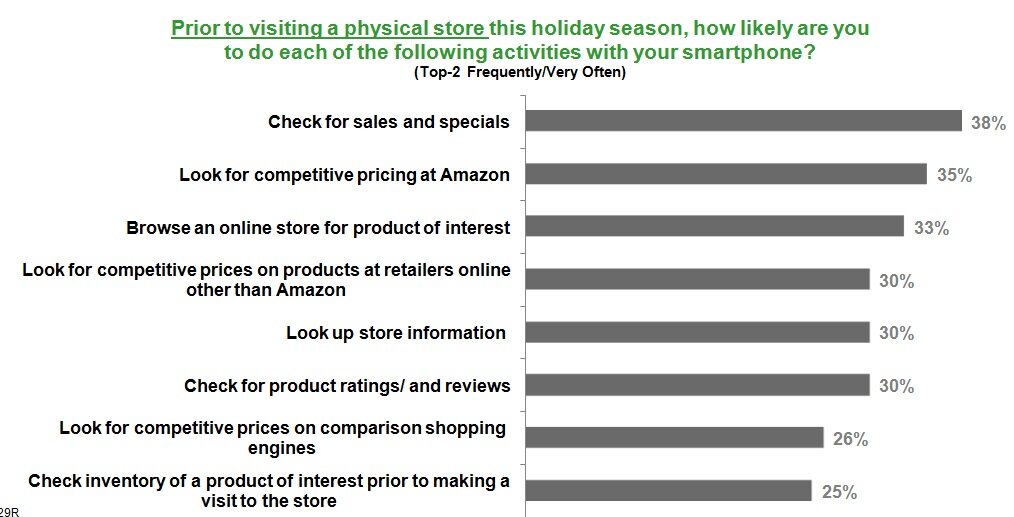

Consider the timing of promotions. Tablet usage spikes in the evenings, according to data from social software provider Bazaarvoice, with 5% of all traffic to shopping sites coming from iPads at 8 p.m. and 11 p.m. — double the amount of tablet traffic generated earlier in the day. The shift to mobile devices makes sense — by day, consumers are tethered to desktops at work — but the surge in tablet traffic is far more dramatic than for smartphones.

To take advantage of this usage pattern, consider the nature and timing of promotions and cater messaging to tablet shoppers as they couch-surf online as well as channel-surf on the TV.

- Do your products have tie-ins to prime-time TV shows or sports events? Consider spotlighting these items during the evening hours.

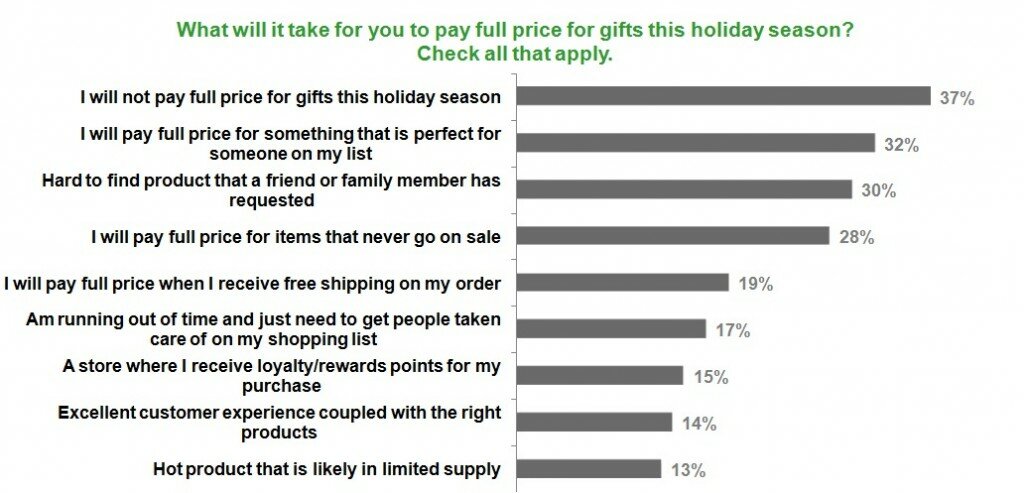

- With tablet shoppers generating a higher average order value, consider “night owl” promotions such as free shipping on full-price items for a limited window of time in the evening, or a nighttime sneak peek at the latest seasonal wares.

- Target email messaging to users with mobile devices, and send those messages during prime time to reach tablet shoppers as they browse.

How substantially do tablet shoppers contribute to your brand’s sales, and how are you catering content and promotions to tablet users?

ut while most merchants have now made customer service links easily accessible on their eCommerce sites, in a recent survey we found that less than 10% of the 40 largest U.S. merchants’ Facebook pages include a customer service phone number – and only one showcased its online chat feature via Facebook. It’s an easy change to make: incorporate customer service information prominently, as Crate & Barrel does on its Facebook page by integrating the customer service number prominently into the anchor graphic on its page.

ut while most merchants have now made customer service links easily accessible on their eCommerce sites, in a recent survey we found that less than 10% of the 40 largest U.S. merchants’ Facebook pages include a customer service phone number – and only one showcased its online chat feature via Facebook. It’s an easy change to make: incorporate customer service information prominently, as Crate & Barrel does on its Facebook page by integrating the customer service number prominently into the anchor graphic on its page.

Connect with us: