Performance Index: Mobile takes center stage

May 15, 2014 Leave a Comment

The latest MarketLive Performance Index, reporting first quarter results, contains heartening news: revenues continued their double-digit growth streak, climbing 18.7% year over year on traffic gains of 13.9%. Average order size also grew, by 4.4%, suggesting that merchants are finding ways to engage shoppers beyond rock-bottom discounts.

But the report also reveals that these gains, impressive as they are, could have been even more substantial. Merchants are missing a key opportunity to win sales, and that opportunity is mobile.

On the one hand, compared with last year, mobile commerce is growing, with revenue from smartphones up nearly 47% and revenue from tablets up more than 30%. But those large percentage gains mask the fact that mobile revenues are significantly underperforming compared with mobile traffic. Most glaringly, 22% of all eCommerce visits originates on a smartphone, but smartphone purchases account for just 6% of revenue — suggesting merchants have a long way to go to make the touchpoint a viable source of sales.

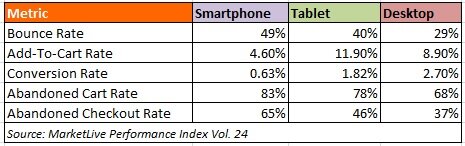

A deeper dive into the numbers reveals still other challenges:

- The need for speed on smartphones. With nearly 1 in 2 smartphone visits ending after a single page, merchants are losing a vast number of potential shoppers before they even engage. As one possible remedy, merchants should conduct performance testing on their mobile sites; the majority of consumers now expect load times of less than three seconds, and are disinclined to return to sites that experienced load time problems, according to performance monitoring firm Gomez. And clumsily-implemented responsive design can drag down performance, so merchants contemplating site overhauls should be vigilant.

- Near-misses on tablets. The add-to-cart rate on tablets is a healthy 11.9% — higher than on desktop sites — but then merchants fail to capitalize on this potential, with the tablet conversion rate lagging at 1.82%. In addition to cart and checkout optimization (more on which below), merchants should also consider the cross-touchpoint habits of their tablet shoppers and cater to those using their devices for research while potentially completing sales elsewhere. “Save cart” and “email cart” options are crucial; merchants should target tablet shoppers with messages incentivizing cross-device access as a benefit of account registration. Additionally, merchants should spotlight options to connect tablet browsers to in-store shopping, such as in-store inventory lookup or the ability to book a personal shopping appointment.

- Major obstacles on the final steps of the path to purchase. The abandoned cart rate for smartphones is a whopping 83%, and 78% on tablets. While these numbers may partly be driven by shoppers using their devices purely for research, the checkout abandonment percentages are also shockingly high, at 65% for smartphones and 46% for tablets — suggesting that even for shoppers committed to making mobile purchases, the process is far from smooth. Our new whitepaper on path-to-purchase optimization, which we’ll cover in greater depth on the blog soon, contains a compendium of best practices related to mobile checkout we can’t recommend highly enough.

Download the full Performance Index report for more insights into mobile, including “day parting” and mobile performance by vertical. How does your mobile performance stack up?

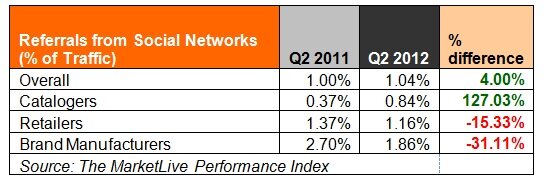

One key area of weakness continues to be social networking. The percentage of shoppers linking to eCommerce sites from social networks has stayed nearly flat from a year ago – rising to 1.04% this year compared with 1.00% in Q2 of 2011. Moreover, retailers and brand manufacturers are flagging in their efforts to drive social traffic, while catalogers – the weakest segment in this regard – are improving, but can still only attribute less than a percent of their visits to social networks. The stagnant performance suggests merchants must continue to find new ways to engage this audience, which is a potential source of not only lucrative sales but also powerful word-of-mouth clout during the holidays.

One key area of weakness continues to be social networking. The percentage of shoppers linking to eCommerce sites from social networks has stayed nearly flat from a year ago – rising to 1.04% this year compared with 1.00% in Q2 of 2011. Moreover, retailers and brand manufacturers are flagging in their efforts to drive social traffic, while catalogers – the weakest segment in this regard – are improving, but can still only attribute less than a percent of their visits to social networks. The stagnant performance suggests merchants must continue to find new ways to engage this audience, which is a potential source of not only lucrative sales but also powerful word-of-mouth clout during the holidays.

Connect with us: